2022 was a banner year for short ideas, no doubt. I have been putting this year-end report card together off-and-on for over a decade now, mainly to try and convince people that, regardless of whatever the market does, that they should be doing more of my ideas and thus hopefully supporting my efforts. So here’s this year’s recap and pitch.

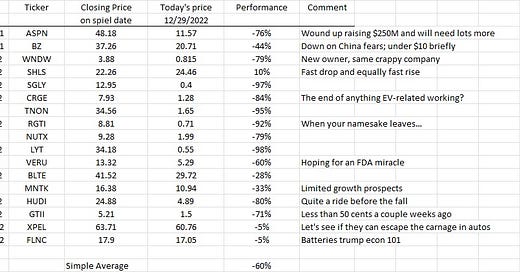

While the S&P and Dow are down maybe 15% for the year and the NASDAQ around 30%, ideas I have chosen to highlight over the last year are down an astonishing 60%, on a simple average, and that’s just since the day I chose to write the spiel and ignores much lower prices on several. What’s more, every single idea that was the subject of its own spiel in 2021 continued to decline in 2022 as well, sometimes over 90%, from where it closed off 2021. My simple average in 2021 was -42%, so down another 90% basically means it’s down 95% or more. Likewise 2020, every single idea (with a poorly timed pre-COVID call on MXL as the lone exception) is down upwards of 99% (OTRK) from where it closed that year. You could have done much worse than blindly putting out every idea I pitched over the past (almost) 3 years, and that includes the entire COVID-induced nuttiness. That is, in fact, the strategy I try to pitch to people, which is rather than going “all in” on a single idea each year to rather have a portfolio of several smaller positions in my names. Anyways, here are the results, and the final chart of the year.

While I do love to point out the frothy and fraudy-type of names, this year’s list had many ideas that were basically normal run-of-the-mill businesses without any issues about the shares or borrowing, and were at least $1B in market cap; basically, everything I’m told people are looking for. Starting the year with ASPN and BZ (I know, they were technically in 2021, but they came after my 2021 year-end report card so were not included), both of which were readily-borrowable stocks, I then pointed out SHLS, which had a 60% decline inside of a month before the US Congress decided to throw money at the solar industry and the stock rallied. I’m still bearish. There was also VERU, MNTK, XPEL, and the recent FLNC, all fairly ordinary companies without any borrow hassles. The folks at CRGE went on the road shortly after my spiel and I heard back from a couple folks that shares became readily available, while RGTI was available but had many of the issues that surrounded most of the SPAC names (names which I have mostly avoided). I even heard of folks getting their hands on shares of HUDI, BLTE, and WNDW, and then of course SGLY must have been available or it wouldn’t have been the subject of another spiel. Overall, hopefully a range of ideas were available for all.

The list of winners in 2022 was, of course, much bigger, and includes many names which, for one reason or another, chose to go on huge rides before coming back down to earth. CVNA would be the poster-child from my own experience (from $20 to $400 to $4, what a horrible ride), but also includes other names that went on COVID-induced spikes including EVER, EXPI, and GSHD. Larger and more ordinary businesses that had large declines in 2022 include RCM, at one point down over 75% from my original spiel, and FTDR, another ordinary company that declined with the housing market. Older names from 2018-2019 that finally got hit in 2022 and are down over 75% include LOOP, BZUN, FANH, CDNA, and ODT, each of which has been readily borrowable for quite a while.

As I close out the year, a big thanks to those who continue to support the work, and let’s hope 2023’s ideas will prove even better.

Thank you.