Even though the past couple of weeks have generally been rough for the market, it still manages to find itself well into the double digits pretty much across the board. Performance-wise, the NASDAQ 100 continues leading the charge with a 30% or so overall gain on the year, with the S&P500 up a solid 25% or so and the lagging DOW30 only up around 15%. The mid-cap Russell 2000? Up a little over 10%.

Against this backdrop I start looking back at the new ideas I have offered to subscribers over the past year, starting with the ideas I call “Quick Takes.”

I spell it out elsewhere (in my about section for one), but a “Quick Take” in general is a name that interests me, but there are still some things that keep me wary. Things that keep me wary can range from what I see as confusing financials, stalling growth rates, concentration of customer issues, declining metrics, and other things that may be signs of a downturn but nothing as of yet has materialized.

These types of ideas had their genesis a long while back when I started to notice that, of the names I did a certain amount of work but for whatever reason decided to pass on them, quite a few would end up working rather well. At that point, rather than just discarding the ideas, I started adding these names to my interest lists with some quick thoughts on why these names may at some point be worthy of attention. Sometimes I would comment further on these names, and other times they would eventually get dropped from my list.

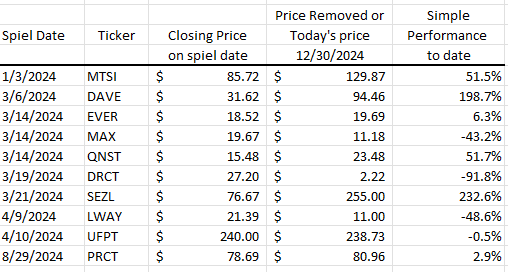

In 2024 there were 10 names that I called “Quick Takes,” and their overall performance was disappointing. This disappointment primarily stems from the early addition of a couple of names in the hot buy-now-pay-later (BNPL) space (a strapped consumer going down the banking food chain is usually not a good thing), with mixed results among the rest of the names. If you exclude those 2 names (if you haven’t noticed, I tend to parse things a bit), the average return for the other 8 names was down 7.0%; if you include those 2 names, the average return was a positive 36%. Were my thoughts on those 2 names just wrong or perhaps just early? A couple of activists have provided some thoughts on both of those names, which leads me to think I was merely early, but time will tell who is right.