2024 Report Card part 2

Strong overall performance in 2024 with core names down an average of 40%

Just a reminder: I have absolutely ZERO position in any of the names I research and discuss; everything I write is for the benefit of my subscribers and no one else. A full disclosure can be found in the “About” section of this Substack. Any compensation I receive is derived strictly from subscriptions and nothing else. As always, nothing here should be considered a recommendation; please discuss with your financial professional.

Today’s focus turns to the new ideas I highlighted over the course of the year that I consider to be regular ideas. This list does not include older names that were introduced either in 2023 or earlier but that have received updates in 2024, nor does it include the “Quick Takes” I sporadically published over the course of the year which received their own comments yesterday, or the 2 names that were exclusive to Founding Members.

Though this annual review has become something of a habit, I recognize that it remains an imperfect measure, since many of the names have been a focus for close to a year while a few have only been a focus for a few days. My quarterly interest lists are likely a better way to track how the ideas are performing over any given length of time, and subscribers have access to those going back several years.

Having said that, today’s discussion will simply be about the 17 new names that I introduced to subscribers during 2024. However, if you include the 10 “quick take” ideas I highlighted in yesterday’s post, and the 2 additional ideas that were for Founding Members, that would be 29 new ideas I presented to subscribers over the last year, making 2024 one of my more productive years in quite a while. That was my original goal when I transitioned to this format, and hopefully I will be able to maintain it.

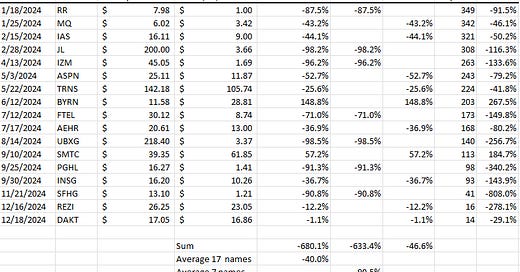

2024 Performance

As in yesterdays “Quick Take” review, I will discuss the results for the group of 17 core names as a whole, and I will also parse it into a couple of smaller groups: the first group consists of 7 ideas that I consider to be the “fake” or “crappy” or “China Hustle” types of names that I just can’t seem to resist sharing, while the second group is companies that are decidedly more real and have actual verifiable businesses.

Why bother? Let’s discuss.

Overall performance down 40%

The overall group of 17 names were down an average of 40% from the date of first mention. Breaking it down, the performance between the two sub-groups varied pretty widely, which is why I believe it’s instructive to take a look at how each group performed. Regardless, down 40% in a market that is up at least 10% (various indexes were mentioned yesterday ranging from up 10% to up 30%+) is a pretty decent showing.

Crappy names down an average of 90.5%

In the group of 7 names that I consider to be either fake or crappy, there were a couple of star performers that were each down over 98% since I first pointed them out to subscribers (they also each had large reverse splits), there were three other names that were each down in excess of 90%, while the remaining two were down in excess of 70%. On average these 7 names were each down 90.5%.

So why do I break this group out? The low public floats and the ability for an investor to easily borrow the shares of each stock would be the primary one. Each name would be considered part of the “China Hustle” list of stocks that came public through a variety of crappy underwriters (some of which I highlighted in a note last month).

These stocks each had a fairly low public float which appeared to be tightly controlled, and gyrated through some incredibly violent swings, sometimes intra-day. Most of the IPO’s were for 1.5M to 2M shares, priced in the $4 range, and always had more liquidity (trading volume) than they ever deserved. These types of names are not only not recommended for the faint of heart, but not recommended at all for the individual investor class.

(As a side note, I can think of worse ways to spend an hour or so a month than by opening up the links to each underwriter I highlighted and taking a look at their newest offerings. Some of the names will inevitably become the focus of bad actors who will manipulate the shares in hopes of causing a squeeze where insiders can unload lots of shares at inflated prices. The majority, however, typically just sink away into obscurity, and usually after the lockup window for insiders has expired. Just pull up their lists of names and start punching up ticker symbols and charts. Funny how that tends to work out.)

One of these names in particular had a mind-boggling one-day move where they forced a certain number of shorts to cover at a ridiculous price only to see it fall 99% in the days afterwards. Just criminal. I have received some feedback from several subscribers that they were able to borrow bits and pieces of some names here and there and maintain the borrow through the volatility, but I’m sure others were not as fortunate.

Real names down an average of 4.7%

The second group of 10 stocks that I consider to be more real names was down on average 4.7% since I first pointed them out to subscribers. As you can tell, the fake names were responsible for the majority of the performance, which is why I believe it only fair to point it out and parse the names on my list.

8 of the 10 names in this second group were down in absolute terms, with the other 2 currently trading higher. The standout in this group is down over 50%, while a couple of others are down over 40%, three others down over 25%, and the last two are down marginally (these are also the most recent 2).

Finally, I will mention the performance of the 2 stocks that were exclusive to the Founder’s Members. The first idea mentioned was down over 55% at one point, while the second idea got caught up in the AI tech bump and is up around 18% since I first mentioned it to those subscribers. Overall average performance for these 2 names is down something over 18%. In 2025, I am looking to expand the number of ideas shared with these subscribers significantly.

Let’s take a look at the individual names by starting with a chart showing all 17 of the stocks and their performance.