Customer concentration stories are typically my cup of tea, but I have held back commenting on AEHR for a couple of reasons. First, back in the late 90’s I looked at the company as a long idea for my former boss, and while I may not have a case of the warm fuzzies for the company, I do tend to look at them at least somewhat favorably; a case of an underdog taking on the industry leaders always makes for a good story. Second, there is the supposed Tesla angle, which should be enough to make anybody think twice. Their largest customer is ON Semiconductor, which is a huge supplier to chips to everything automotive, but especially to EV’s and their charging infrastructure. The developed world appears hell-bent on making the EV future a reality regardless of cost, and there’s no denying we are still in the early innings of that particular game. So I’ve been watching to see how the story develops, and possibly pick out the point where the company makes one promise too many in order to keep the momentum going, and that may have just occurred.

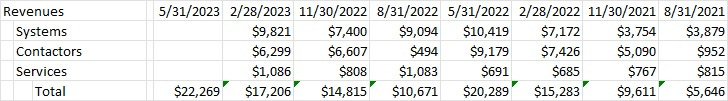

The company announced FY2023 results yesterday (they are on a weird May quarter) where they showed a $65M revenue year, up from a $50M revenue year, or up 30%. The company is now guiding towards $100M+ for FY2024, or up about 80%, which would be an average of $25M a quarter for the entire year, which is quite a bit better than what they managed in 2023. That naturally leads to the question of whether or not there are any signs out there currently that they company is going to be able to achieve that. The company just printed a $22.3M year-end quarter, which is the best in their history, and up only slightly from the $20.3M they printed in the year-ago period. They do expect the year to be basically a 40%/60% year, so back-half loaded, so quite a lot would depend upon what they currently have in the pipeline. Let’s take a look at that.

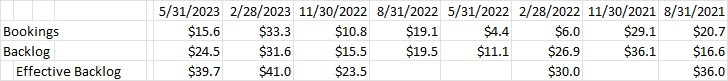

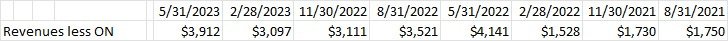

By the looks, the company does have a couple of quarters worth of revenues in their “effective backlog.” The company defines “effective backlog” as basically the ending backlog plus the bookings they have received since the quarter end. So their $24.5M backlog at quarter and year end plus what should be about $15.2M in bookings since the quarter end (about 6 weeks) would give us the effective backlog. There are some gaps because I couldn’t find a mention of their “effective backlog” all the time, but it’s not really an important metric because it doesn’t really indicate what the number will be at the end of the quarter; it’s simply all over the place. If you add up the bookings and the backlog during any one period, we see that it can take anywhere from 2-3 quarters for those revenues to be fully realized. Revenues during those following quarters looked like this.

So nothing in the numbers so far indicates that there should be any sort of acceleration in the quarters going forward, though it appears they are in a fairly comfortable place currently. The bookings number in Q4 were sorta punk, the bookings quarter-to-date are about the same so far, but that number has not been really indicative of what we can expect to see at quarter end, but if anything it appears orders are front-loaded in each quarter. Their backlog declined as it did in the prior period, but are still doing a bit better than they have been historically. Combined, the number is at the higher end of what they have shown over the past 8 quarters, but not significantly so. So at the moment, nothing super special appears to be on the horizon. That’s where the customer concentration issue become relevant.

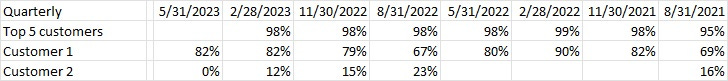

The company has been saying in their press releases and on their conference calls that they are shipping to new customers, and at the end of the May quarter they announced that during the year they had shipped to 4 new customers trying out their Silicon-Carbide test systems (the EV angle). When asked on their conference call how many 10% plus customers are expected in their guidance, they indicated they expect 3-4, including their “lead semiconductor customer.” During the last year they had 2 customers that were 10% plus, with the largest at 79% and the next at 10%. As you can see, the second largest customer was not a factor in Q4, while the largest continues stepping it up. On a dollar basis, here is what those percentages look like.

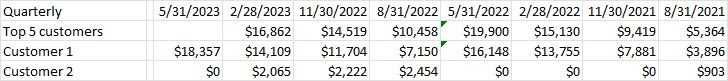

Which leads me to my final chart. If you were to take their revenues and exclude their largest customer over the last 8 quarters, here is what their revenues would be.

Once again, no real signs that their systems and solutions are really catching on with anybody else but their largest customer. Take away the contributions from this largest customers and year over year revenues actually declined in Q4. Yes, I get that the sales cycles for some of these installations is probably more than a couple of quarters. Listen to the call and the company is excited about their prospects and is fielding requests from practically every company out there, and they hired some senior sales personnel to pitch their story. Has any of that turned into actual sales at this point? Hard to say. Is it possible it will at some point? Perhaps.

As a final note, AEHR is not especially cheap. They are guiding towards maybe $1 a share in untaxed earnings which would give them roughly a 50x multiple on untaxed earnings. On their $100M or so in expected revenues, they are trading for roughly 15x revenues. I know, for the EV space, both of those are probably considered cheap, but for the semiconductor capital equipment space, it’s kinda pricey. Could be why they’re choosing to sell shares using at ATM offering rather than something more traditional.