Pull up a weekly chart of Singapore-based FNGR and you’ll find a stock that is subject to some pretty dramatic rises followed by what seem to be some equally dramatic falls. In an attempt to capitalize on their stock’s most recent rise, the folks over at FNGR thought it appropriate to file an S-3 to register $300M worth of new shares and warrants for sale along with $25M worth of shares under an at-the-money offering. Running the books on the offering is Univest Securities, the folks who brought us HUDI, the subject of another story followed by its own dramatic run several months back.

FingerMotion, Inc. – (FNGR - $7.02)

Shares Outstanding: 52.5M + 4.8M options and warrants

While the company’s chart and recent rise is pretty spectacular and certainly worthy of a second glance, the company’s name is admittedly what originally caught my eye. At one point in time my kids had this somewhat eccentric Juilliard-trained piano tutor who was a stickler for how my kids would position their hands over the keyboard. They were all boys, none of them particularly wanted to be there, and that tended to show through in their posture and playing. Anyways, as he attempted to correct their hand and finger positions, cries of “hand motion” and “finger motion” used to permeate the house on practice days. Funny the little things that stick with you.

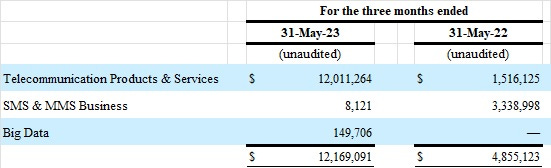

The company FingerMotion itself purports to have its fingers in quite a few little businesses, listing “Telecommunications Products & Services,” “SMS & MMS Business,” and “Big Data” in the section where they break out revenues. Any bets on which business line has suddenly caught the attention of investors? Prior to what we see today, the original company was a shell from something called Property Management Corp., into which Chinese mobile gaming company Finger Motion Company Ltd. reverse merged into in 2017. The newly christened FingerMotion Inc. didn’t really have much of a business and reported little revenues making mobile games, and today that business is basically shut down, so they opted to go the VIE route and invest in some additional Chinese businesses. The first of these was JiuGe Technology, which would be the one with the Telecom plans, followed by the acquisition of something called Beijing XunLian (BX), a discounted provider of bulk SMS messages. They also decided to start up a financial division that “has been activated for the insurtech business during the last quarter of the fiscal year where the Big Data division secured its first contract and recorded revenue.” This division started in 2000 and was idle until recently, but is where the “Big Data” hype got its start.

The company gets caught omitting a major shareholder’s interest. In the company recently-filed 10K/A, which is an amendment to their annual 10K filing, they did so to correct a couple of errors, the more interesting of which is that 4M shares of the company’s stock is owned by one Terren S. Peizer and his Acuitas Group Holdings LLC and Acuitas Capital LLC. Which itself is odd, since Mr. Peizer filed his 13G on October 10th, 2022 (uploaded to the EDGAR system on 11/18/22), while the companys’ following proxy didn’t appear until January 6th 2023, so it’s not like there was some time issue. Looking at the Peizer filing, the company disclosed 46.3M total shares outstanding, while only a month earlier in an S-1 filing for stock held by Lind Global Fund there were only 42.8M shares outstanding. No share offerings in between. Sometime there is a mention of how the holder acquired the shares and at what prices, but all of that is lacking in this filing. Very odd. Also, Mr. Peizer is not one known for buying shares at the market, but rather through a private transaction, and I can’t seem to find one mentioning it. You can also see that on October 10th, 2022, the stock was at the tail end of a huge run-up, which also is not a hallmark of Mr. Peizer’s buying patterns. Cashing in on a pump and dump, absolutely, but buying into one? Unlikely. As a refresher, Terren S. Peizer is the former Milken confidant and ex-CEO of one-time idea OTRK and who was also recently charged by both the SEC and DOJ for insider trading charges of his very own. Michael Milken is probably having himself a chuckle somewhere; a long-delayed chuckle, perhaps, but still a chuckle. Mr. Peizer, meanwhile, is scheduled to go to trial in April 2024.

The new “Big Data” story… Shares of FNGR most recently came to life after calling themselves a “Big Data” company in their May 30th, 2023 press release where they announced their FY2023 financial results. Apparently they have a “business intelligence” unit called Sapientus that signed an agreement at the end of 2022 with German insurer Munich Re for exploring ways to enter the Chinese market. Though news of that little alliance was eventually sold shortly after it was announced, it appears the recent hype behind AI has brought it all back to life. That momentum continued as they kept the “Big Data” narrative going in Q1 and investors that were focused on anything “AI” picked up on the story.

..is really just a continuation of the old story. Same companies involved, too. There’s this press release from 2021 regarding FNGR and Munich Re doing much the same thing that, well, they recently announced. Then there was this press release about their collaboration with Happy Life Insurance (must be Chinese). Then of course we had this press release that put them together with another large US-based company, this time Pacific Life Re. So these insurance tie-ups with their Sapientus insuretech subsidiary have happened in the past, with nothing worthwhile ever being produced.

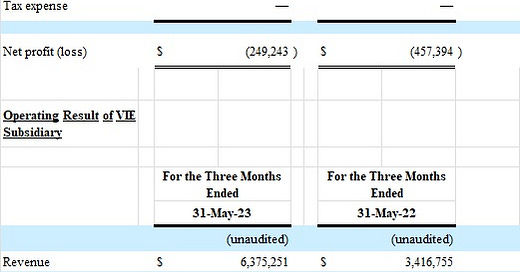

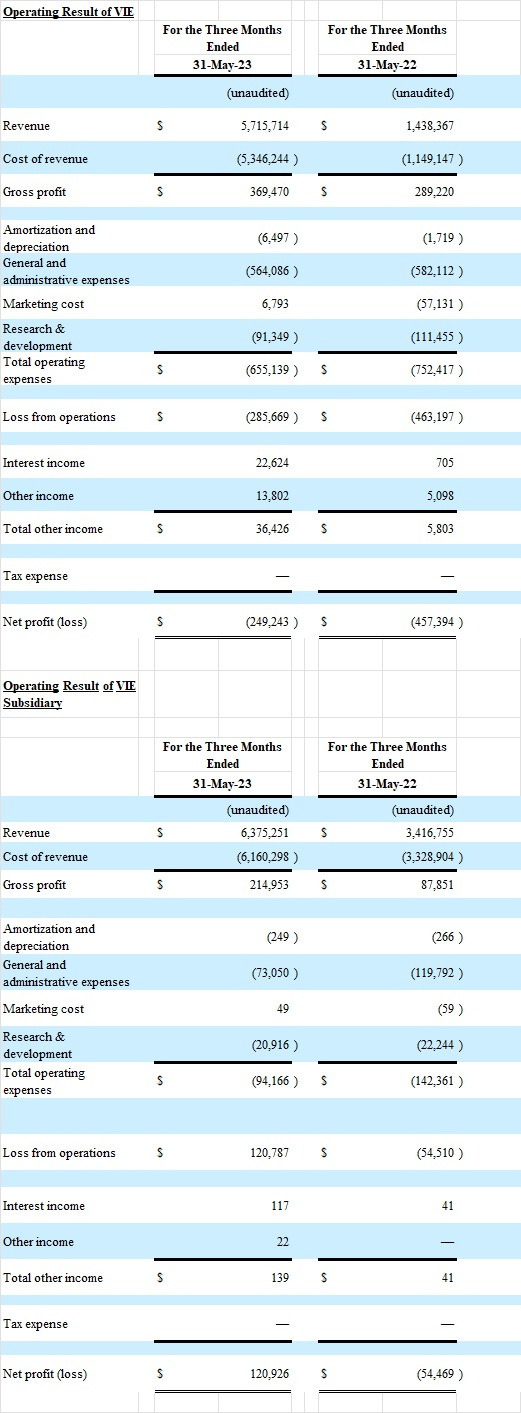

The VIE’s are where all the revenues lie. As you can see from their exhibits, of the $12.169M of revenues the company reported at the end of May 2023, a solid $12.1M came through their VIE’s located somewhere in China. Of course, the whole VIE structure is simply a license to steal, and the company even admits that.

“Under the current VIE arrangements, as a legal matter, if JiuGe Technology fails to perform its obligations under these contractual arrangements, we may have to (i) incur substantial costs and resources to enforce such arrangements, and (ii) rely on legal remedies under PRC law, which we cannot be sure would be effective. Therefore, if we are unable to effectively control JiuGe Technology, it may have an adverse effect on our ability to achieve our business objectives and grow our revenues.”

Going concern statement. I added the BOLD to the one sentence.

“The accompanying condensed consolidated financial statements have been prepared assuming the Company will continue as a going concern, which contemplates, among other things, the realization of assets and satisfaction of liabilities in the normal course of business. The Company had an accumulated deficit of $25,956,785 and $24,691,314 as at May 31, 2023 and February 28, 2023 respectively, and had a net loss of $1,264,262 and $1,444,668 for the three months ended May 31, 2023 and 2022, respectively.

The Company’s continuation as a going concern is dependent on its ability to obtain additional financing to fund operations, implement its business model, and ultimately, attain profitable operations. The Company will need to secure additional funds through various means, including equity and debt financing or any similar financing. There can be no assurance that the Company will be able to obtain additional equity or debt financing, if and when needed, on terms acceptable to the Company, or at all. Any additional equity or debt financing may involve substantial dilution to the Company’s stockholders, restrictive covenants or high interest costs. The Company’s long-term liquidity also depends upon its ability to generate revenues and achieve profitability.”

SMS & MMS is dying, Telecoms is thriving, and Big Data is tiny. Revenue breakdown from the most recent quarter. Total SMS & MMS Business revenues in FY2023 were $6.6m and in FY2022 they were $14.1M and the decline into FY2024 has accelerated. Those revenues are being replaced by “Telecommunications Products & Services.”

As Telecommunications revenues increase, gross margins continue to shrink. In FY2023 the company showed a gross profit of $2.3M on revenues of $34.1M for a 6.7% gross margin while in FY2022 they had gross profits of $2.8M on revenues of $22.9M for a 12.2% gross margin. The problem, of course, is they are replacing one incredibly low margin business with another even lower gross margin business. In 1Q2024 their gross margin declined even further to 5.4%. The company’s “Telecommunications Products & Services” come from “providing mobile payment and recharge services to customers of China Unicom and China Mobile.” A payment service provider to the 2 big mobile telecom companies in China doesn’t sound too bad, though. Does it?

“We earn a rebate from each telecommunications company on the funds paid by consumers to the telecommunications companies we process. To encourage consumers to utilize our portal instead of using our competitors’ platforms or paying China Unicom or China Mobile directly, we offer mobile data and talk time at a rate discounted from these companies’ stated rates, which are also the rates we must pay to them to purchase the mobile data and talk time provided to consumers through the use of our platform. Accordingly, we earn income on the rebates we receive from China Unicom and China Mobile, reduced by the amounts by which we discount the mobile data and talk time sold through our platform.”

Telecom revenues are reliant on their 2 major customers. Most of their revenues could simply vanish overnight, or so says their disclosure.

“We currently derive a substantial amount of our total revenue through contracts secured with China Unicom and China Mobile. If we were to lose the business of one or both of these mobile telecommunications companies, if either were to fail to fulfill its obligations to us, if either were to experience difficulty in paying rebates to us on a timely basis, if either negotiated lower pricing terms, or if either increased the number of licensed payment portals it permits to process its payments, it could have a material adverse effect on our competitive position, business, financial condition, results of operations and cash flows. Additionally, we cannot guarantee that the volume of revenue we earn from China Unicom and China Mobile will remain consistent going forward. Any substantial change in our relationships with either China Unicom or China Mobile, or both, whether due to actions by our competitors, regulatory authorities, industry factors or otherwise, could have a material adverse effect on our business, financial condition and results of operations.

Oh heck, there are just so many more interesting disclosures in their filings, let’s do a few more. The Li Li in question here, btw, happens to run JiuGe Technology, which is a VIE, or as they like to put it a “contractually controlled” company that also happens to be responsible for almost all of their current revenues. Should either the China Unicom or China Mobile business ever become a really good business, is there anything keeping Li Li from just cancelling their VIE agreement and walking away? Her $120K annual salary?

“Li Li is the legal representative and general manager, and also a shareholder of JiuGe Technology. There could be conflicts that arise from time to time between our interests and the interests of Ms. Li. There could also be conflicts that arise between us and JiuGe Technology that would require our shareholders and JiuGe Technology’s shareholders to vote on corporate actions necessary to resolve the conflict. There can be no assurance in any such circumstances that Ms. Li will vote her shares in our best interest or otherwise act in the best interests of our company. If Ms. Li fails to act in our best interests, our operating performance and future growth could be adversely affected.”

“We operate our mobile data business in China on the basis of the approval certificates, business license and other requisite licenses held by JiuGe Management and JiuGe Technology. There is no assurance that JiuGe Management and JiuGe Technology will be able to renew their licenses or certificates when their terms expire with substantially similar terms as the ones they currently hold.”

“Under the VIE Agreements, JiuGe Technology’s shareholders have granted JiuGe Management an option for the maximum period of time permitted by law to purchase all of the equity interest in JiuGe Technology at a price equal to one dollar or the lowest applicable price allowable by PRC laws and regulations. As JiuGe Technology is already our contractually controlled affiliate, JiuGe Management’s exercising of the option would not bring immediate benefits to our company, and payment of the purchase prices could adversely affect our financial position.”

Paying expenses with stock. Another troubling sign for companies is when they decide to start issuing stock to “consultants” and “lenders” rather than paying with cash on hand. Here is a small piece from their recent 10Q regarding issuing shares for services, but the entire entry is 3 pages long and has dozens of occurrences over the past couple of years. Their EDGAR filings also have Form D’s every month or so and various amounts for stock they issue for services.

On February 28, 2023, the Company issued 7,500 shares of our common stock at a deemed price of $2.47 per share to one entity pursuant to a consulting agreement.

On March 17, 2023, we issued 2,465,816 shares of common stock at price of $0.863 per share to our primary lender pursuant to the conversion of $2,128,000 of principal amount of the Note issued to our primary lender on August 9, 2022.

On April 18, 2023, we issued 20,000 shares of common stock at a price of $3.00 per share pursuant to the exercise of warrants.

On April 24, 2023, we issued 70,000 shares of our common stock at a deemed price of $1.64 per share to one entity pursuant to a consulting agreement.

As of May 31, 2023 there were 51,988,030 shares of the Company’s common stock issued and outstanding, and none of the preferred shares were issued and outstanding.

The “cashless” offering.

“On August 9, 2022, the Company entered into a Securities Purchase Agreement with an investor (the “Investor”), pursuant to which the Company issued to the Investor a common stock purchase warrant (the “Warrant”) to acquire 3,478,261 shares of common stock of the Company, which is subject to reduction by 50% upon effectiveness of the registration statement covering the underlying shares.”

Repricing options. Not once, but twice!!!

“At our annual meeting of stockholders held on February 17, 2023, the stockholders approved an amendment to the exercise price of the outstanding stock options from $8.00 to $3.84.”

“approve lowering the floor price under the note and warrant held by the Company’s primary lender from $0.86 to $0.50 per share of the Company’s common stock”

When all else fails, blame the shorts. Yep, and hire not one but two law firms to find those dastardly naked shorts.

Judging from the chatter and bullish spiels such as this one, there appears to be some hope that between a tough borrow (short interest is not high, though the stock appears to be a tough find) and continued hysterics and cries of “naked” short selling that the bulls will be able to continue pushing the shares higher. A while back I wrote something up on Charge Enterprises (CRGE), a company that was supposed to be installing car chargers around New England but had most of their revenues coming from reselling telecom minutes to businesses, much like what we have with FNGR. CRGE managed to buy around $500M worth of annual revenues for under $1M, all because the margins on reselling telecom minutes are incredibly skinny. I imagine FNGR is going to find that business much the same. Even if under that bullish spiel I linked above, and FNGR somehow manages to stumble into $100M worth of Telecom revenues this fiscal year at the 5% margin level they just posted, then that’s only $5M worth of gross margin for the YEAR for a company that just had $1.8M worth of operating expenses in a single quarter. Should this Munch Re relationship conclude, which I would imagine it will, then this becomes another worthless Chinese telecom reseller with nothing much else going for it.