ICZOOM Group Inc. - IZM

Is there any appetite out there for ideas like this? A walk through the process.

A long-time client reached out to me the other day and asked if I had any thoughts on the inexplicable rise in the shares of ICZOOM Group (IZM - $45.05). Though I tend to pass on most of these types of names, I do pick one up every now and then, and this one certainly appeared ripe for the picking. The most recent story I wrote up resembling this one was J-Long Group (JL) which worked out rather nicely, so perhaps this one may offer a similar opportunity. So I took a quick glance at their IPO prospectus from March 2023 and some of their recent filings, and needless to say, those were pretty much enough to make me take a hard pass.

A hard pass not from the sense that this is a screaming buy or anything, far from it actually, but a hard pass because it likely makes for an incredibly frustrating short idea.

Why? Well, rather than just burying it and walking away, I thought it might prove helpful to share some of things that I looked at, and then add some of my thinking about why it might make for a frustrating idea.

First off, take a look at the original prospectus and what they’re offering:

Tiny floats are fertile ground for the manipulators, which helps explain the recent stock move, and 1.5M shares is really nothing. There are also like 4M class B shares out there owned by management with super-voting rights, but those aren’t part of the float (though if I was a betting man, I would think the management group is falling all over themselves to register and sell some shares if they haven’t done so already). Anybody looking for a borrow would be lucky to get a handful of shares, and since I’m going after an institutionally oriented subscriber base with some meaningful investable assets, that just won’t do. For the P.A. maybe, but unlikely for the fund.

Assuming you could find some shares to make a difference and this would be of some interest, and digging a little deeper, you take a look at who is the underwriter?

Not a top tier outfit by any stretch, which is typical in names like this.

By the way, if you look at their initial F-1 filing from back in 2021, there was a different underwriter listed. Not sure Benchmark is exactly an upgrade, but hey, they got the job done at least, which in itself is kinda weird. Think about it: it took 2 years to get this deal done, and it was only 1.5M shares at $4, which is really nothing. Back in 2021 they were showing top-line growth of 60% or so, while 2022 revenues were basically flat and 2023 revenues took a 25% dive. They couldn’t get the deal done when their financials looked reasonably better, but were able to close the deal when things are falling apart? Makes little sense. Anyways, that first underwriter was…

As Prime Number Capital says in their bio, “connecting US and Asia,” and aren’t we all better off for it!

Next thing that would typically be of interest is the management team, and finding out what is the CEO’s background perhaps?

Oh dear, that’s not good. I have a client who pretty much follows around failed executives and does very well betting against them wherever they happen to pop up, and you may be surprised at how often they do pop back up. And what did SinoHub do?

Wait a second, that sounds kinda familiar. What exactly does IZM supposedly do again (their presentation makes some other claims)?

(Those “service commission fees” are only around 1% of the total, btw.)

Oh, great, so after SinoHub blew up in 2015 and shareholders were left with nothing, the CEO basically went across the street and started another company doing the exact same thing but with a different name. Wonderful. Now he’s looking for a new group of suckers, er, rather, shareholders, to join him in his next endeavor. And we’re naturally the only country with a stock exchange dumb enough and regulators too accommodating (I’m trying to be nice…) to help fund enterprises like this one. In the end, US investors will once again be left holding the bag once this second iteration inevitably blows itself up.

Oh, and wouldn’t you know it, now they’re looking to raise even more money…

And they even picked up another underwriter. They’re learning how the game is supposed to be played…

As we saw recently with shares of ISPR, whenever low-float deals like these try raising additional funds, they typically wind up doing so far in the hole (in other words, way below the current market price). In ISPR’s case, the stock was trading north of $10 one day and $6 the next day. I wouldn’t be surprised if one day we all wake up and find that IZM sold their 1.3M additional “units” for like $6 a share (the new prospectus assumes $9.08), and the stock opens down around there. Won’t all these buyers in the $40’s just be happy? There are many institutions out there that specialize in funding these types of deals and they typically require huge concessions, though perhaps there is an institution out there dumb enough to fund these folks at $46, but I tend to doubt it.

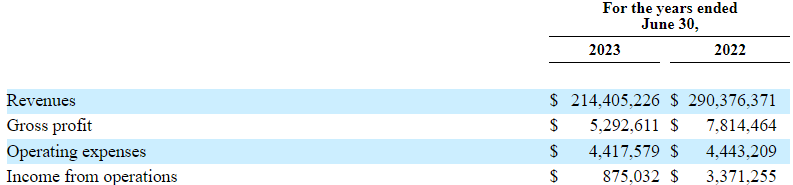

Is it any wonder? Who is going to buy something like this with these financials? Remember, it’s now April, and the most recent financials they have provided date back to June 30th, 2023. Take a look at the Chinese market over the past 10 months and take a guess at how things are likely going.

So revenues are getting crushed, profitability is getting crushed, and how about that balance sheet? Don’t even look, it’s just a mess. When revenues decline 25% and receivables stay flat (stretching out DSO’s), there’s something going wrong collecting from customers. They say that as of the date of the prospectus, which is March 11th 2024, that they collected only 63.1% of their outstanding June 30th 2023 receivables, meaning almost 40% of them are at least 9 months overdue. They carry barely any reserves against those receivables, because there are absolutely no issues here, right?

Maybe I’m just actively watching for things like this, but these types of deals seem to happen way too often. A crappy, usually Chinese company (these folks argue that they are based in Singapore, though they have a Chinese address on their filings and all of their revenues derive from either Hong Kong or China), comes public in the US with a third-tier underwriter in a tiny, 1.5M share low-priced offering, and at some point a chat board discovers it doesn’t take a whole lot of volume to move the thing around, and before you know it, it’s off to the races.

From a short seller’s perspective, names like these are incredibly frustrating, and the main reason I typically pass on these types of names. Stocks like these aren’t typically placed with institutional investors that keep them in their prime brokerage account at a major firm like Goldman, JP Morgan, or Morgan Stanley (the most popular 3 I believe), which limits the ability of most hedge funds to borrow the shares should that ever be of interest. The people who buy and trade these types of names are more likely going through Robinhood or Webull than anyplace your typical hedge fund has a relationship.

If you look at the NASDAQ web site for short interest, it’s not like there is a ton out there, though these numbers all come before the stock’s recent move.

And in the odd case where the prime broker is able to locate a few shares, the negative rebate on those shares is ridiculously high and the shares are typically broker shares (not a very trustworthy or secure borrow), which can be called away at any moment. So even if the borrower was willing to risk the volatility that is inherent with names like these, there is a rather high probability that they would get the shares called away from them at some point and be forced to cover (usually at the worst time, naturally).

Which is the reason most folks tend to take a hard pass on names like this.

Comments?

Low float Chinese is a high probability deal of being manipulate by insiders from one of their offices in Singapore or whatever place they are operating from. I avoid those as a plague. No weak fundamentals and outright fraud stops those from brazent manipulation, and they know the U.S. regulators can't touch them outside U.S.

I have a bad history with Chines those. For me just not worth the risk.