Shares of ISPR have been particularly bouncy of late, so I thought it might be an opportune moment to take a bit closer of a look. Back when I originally added this to my interest list last month, it had all the signs of another Chinese-based company looking for some US suckers, er, shareholders, to buy their shares since god forbid they should try to list their shares closer to home. Crappy underwriters? US Tiger Securities, TFI Securities, and Prime Number Capital LLC. Convoluted related party transactions and balances due to or owed by those same related parties? Check. Offshore entities holding all of the primary assets? Check. A no-name auditor hired less than a year prior to the IPO? That would be an outfit called MSPC. All they were missing was some crappy generic product that was difficult to track and the story would basically write itself. That’s where the cannabis and tobacco vaping products enter the story, which required some further examination.

Ispire Technology Inc. (ISPR - $13.74)

Shares Outstanding: 54.27M

ISPR came public back in April in a 2.7M share offering by the company plus an additional 1.75M shares sold by a couple of their major shareholders. Both of those shareholders, Reliance Lead Company Ltd. (1,212,500) and Jerry Dragon Advisory LLC (537,500) supposedly owned stakes in Aspire Global before their reorganization and prior to transitioning to a public company, and both of these shareholders sold their entire stakes in the IPO (in their filings the company mentions granting a “consultant” a 1.1% stake in the company, or 537K shares, for services performed during their reorganization). The company itself sells both tobacco and cannabis vaping products, all of which are manufactured in China by a company called Shenzhen Yi Jia, owned by ISPR’s CEO Tuanfang Liu. As part of the company’s reorganization and prior to filing to become a publicly traded company, the CEO transferred the rights to all of the company’s intellectual property for the entire world except for China and Russia to the newly christened Ispire; he maintains China and Russia for himself. Unfortunately for him, those rights weren’t quite worth what he thought they would be.

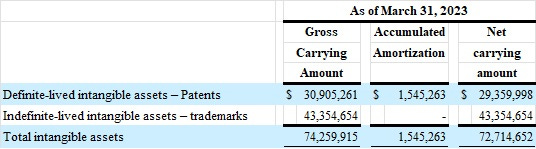

How to wipe out half your assets in one fell swoop. In their original Q3 2023 10Q filing, the company had a total of $141.96M in assets on their balance sheet. In their restated Q3 2023 10Q filing, the total assets dropped to $69.25M. The culprit? The company’s founders transferred their “intellectual property” to the company at what an “independent valuation” determined to be a fair value of $75M. Turns out, it should have been zero.

“On September 30, 2022, an intellectual property transfer agreement and an exclusive license agreement was signed such that all patents, trademarks, Know-how and Know-how Documentation related to cannabis vaping products and tobacco vaping products were transferred from Tuanfang Liu, Aspire Global and Shenzhen Yi Jia to Aspire North America and Aspire Science. As the intangible assets were transferred from Tuanfang Liu, the chief executive officer and controlling stockholder, and the companies controlled by Tuanfang Liu, the transfer was considered as a capital contribution by the stockholder, which is shown as a transaction on the statements of changes in stockholders’ equity. The Company engaged a third party firm to perform a valuation to estimate the fair values of the intangible assets transferred, in accordance with ASC 350.”

“In September 2022, certain intangible assets were transferred to us by a controlling stockholder. The value of the transferred assets was initially determined based on the fair value of the assets. Because the transfer was from a controlling stockholder, under GAAP, the transfer should have been recorded at the value on the books of the transferor and not at fair market value. In our unaudited condensed consolidated statements of changes in stockholders’ equity, we reflected the transfer of the intangible assets at the fair value of $74,259,915 rather than the carrying cost of nil.”

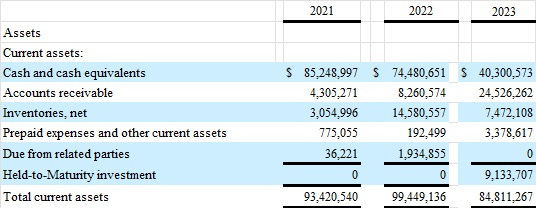

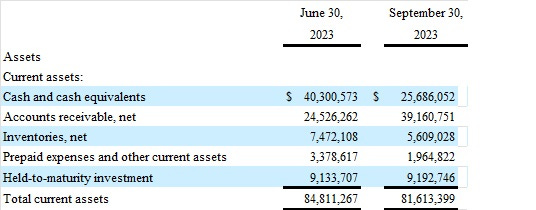

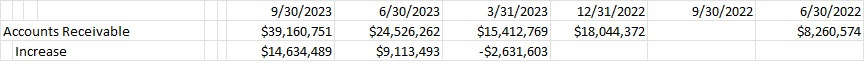

Cash and Receivables go hand in hand. “Follow the money” is a refrain you often hear, and is one to keep in mind when looking at the financials of ISPR. The earliest balance sheet supplied by the company goes back to June 30th, 2021, where the company had something over $85M in cash on hand plus $4.3M in receivables and $3M of inventories. A year later their cash balance had shrunk down to $74.5M while receivables jumped to $8.2M and at the end of June 2023 cash had fallen even further to $40.3M (and that’s after the IPO) while receivables tripled to $24.5M.

Take a peek at recently announced Q1 2024 results and the cash balances continue their decline while receivables continue their march higher. The “held-to-maturity investment” is supposedly a CD that matures in February 2024 and which the company plans on holding until maturity.

Due to related parties. On December 31st 2022 the company showed that they owed $40.5M to related parties, pretty much all of which was due to something called Eigate (Hong Kong) Technology Co. Ltd, which turns out to be a wholly-owned subsidiary of Aspire Global, which in turn is owned by CEO Tuanfang Liu. At the end of December the company supposedly held $84M in cash on their balance sheet, and through the first half of that fiscal year had increased those balances by an overall $9.8M in cash. By the end of March 2023 those cash balances had declined to $24M and the $40.5M owed to related parties had vanished. In April the company would go on to complete their IPO and received $21.735M in proceeds, and by the end of June their cash balances recovered somewhat to $40M.

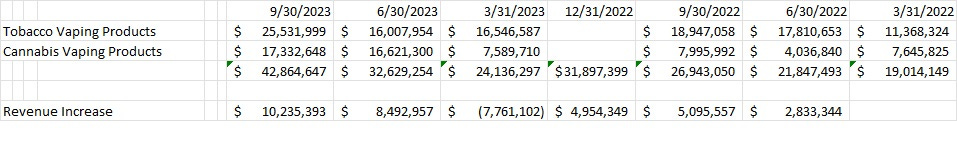

That amazing revenue and receivables jump just may be related. Back when the company came public in April, they announced their recently completed March 31st 2023 results where they posted $16.5M in tobacco revenues and $7.6M in cannabis vaping product revenues for a total of $24.1M. This compared fairly evenly with September 30th 2022 results that they highlighted in their prospectus when they had $26.9M in overall revenues that were down a bit from the December 31st, 2022 quarter when they recognized $31.9M of revenues. Since the company has been public their results have shown a noticeable improvement.

This improvement matches up fairly impressively with the equally dramatic rise in their accounts receivables. The company does mention that they introduced a new product and reduced inventory to blow out their older lines, but there also may be some easier payment or credit terms to account for the rise. Some receivables data points are missing due to the company only recently becoming a reporting entity.

Another way to look at this increase: since June 30th, 2022, when the company had $8.26M worth of receivables until September 30th when they showed $39.2M, or roughly a $31M increase in 15 months, the company has recognized $158M in revenues, so outstanding receivables balances make up over 20% of that increase. If DSO’s happen to be your thing, then DSO’s have gone up from 34 days back in June 2022 to 83 days in September 2023. Now, maybe 83 days is a more realistic number than 34 days, but it is a huge rise nonetheless.

Receivables have some very generous terms. The company’s allowance for doubtful accounts stood at $1.1M at the end of September 2023, which was up from $0 at the end of September 2022. In their public filings, the company only recently appears to have started setting aside a reserve balance. In the most recent quarter they also wrote off some of those balances.

“The Company recorded $0 and $225,487 bad debt expense for the three months ended September 30, 2022 and 2023, respectively. For the three months ended September 30, 2022 and 2023, the Company wrote off accounts receivable against allowance for credit losses of $0 and $628,359, respectively.”

In general, the company has some of the most favorable terms to their distributor customers that I have ever seen. They explain it thus:

“The Company maintains an allowance for potential credit losses on accounts receivable. The Company reviews accounts receivable on a periodic basis, and makes provisions of 80% for accounts receivable aged between 1.5 years to 2 years, and 100% for balances aged over 2 years. Additionally, specific provisions are made when there is doubt as to collectability of individual balances. In evaluating the collectability of individual receivable balances, the Company considers many factors, including the age of the balance, the customer’s payment history, the customer’s current credit-worthiness and current economic trends.”

If you can extend the payables, does it really matter? While the company doesn’t wait 1.5 years to pay related party Shenzhen Yi Jia for the products they make and send over, they do stretch it out to maybe 180 days or so. At the end of September their related party payables balance was at $50.5M and was as high as $67.3M at the end of December. The ability to extend their payables as the receivables balances continue their march higher will be key to maintaining their liquidity, but should that falter, then some sort of an offering of stock could make up for it.

Minimal markup on a product in a highly competitive market. All of the company’s products are manufactured by related party Shenzhen Yi Jia in China, which sells the products to the company at prices and terms similar to those it sells to any other distributor and which the company then must sell to their own distributors. There are at least 2 layers of distributors between the manufacturer and the retailer selling their products. The company’s COGS in FY 2022 were $52.999M, which equals the amount they said they purchased from related entity Shenzhen Yi Jia of $52,998,928 which gave them a 16.5% gross margin. The same in FY 2023, where COGS were $74.789M and purchases from Shenzhen Yi Jia were $74,787,679 and works out to a gross margin of 15.1%. The most recent quarter ended September 30th 2023? Gross profit margin of 16.1%.

“Although our supply agreements with Shenzhen Yi Jia require Shenzhen Yi Jia to sell products to us at the most favorable market price that it sells similar products to third parties, because our products are designed for us and based on technology that was either developed by Mr. Liu prior to the date of the agreement or is developed by us, we cannot determine whether another supplier would be able to provide the products at the same or a better price. “

The US market proved too competitive for their tobacco vaping products and is an example of what happens when marketing declines. The company explains their reasoning thus:

“Although we sold tobacco products in the United States in the years ended June 30, 2021 and 2022, we are limited in the product we may sell and, because the sales did not justify the marketing and regulatory costs, we have ceased marketing tobacco vaping products in the United States”

“Our tobacco vaping sales in the United States were approximately $0.4 million and $0.1 million for the three months ended September 30, 2022 and 2023, respectively. Because the volume of sales did not justify the marketing and regulatory costs, we have ceased marketing tobacco vaping products in the United States.”

“We currently sell our cannabis vaping hardware only in the United States, and we have recently commenced marketing activities in Canada and Europe, primarily in the European Union. All of our cannabis products are vaping hardware.”

While US nicotine sales may be minimal, their cannabis sales are not, so will the US FDA be an issue at some point? From their filings:

“On March 17, 2021, the FDA issued letters to four companies operating in the e-cigarette industry, including Aspire North America, requesting documents related to their social media marketing practices.”

“On June 15, 2021, Aspire North America provided the required information to the FDA. To date, the FDA has not substantively responded or taken any further action in the matter. However, we cannot assure you that the FDA will consider the response adequate and will not initiate regulatory or enforcement action based on an alleged failure to comply with the request or that the FDA will not initiate regulatory or enforcement action on other grounds based on the contents of the documents produced in the response.”

Their European market revenues are primarily due to a single distributor. At the end of September 2023, they had a single 10%+ customer which was listed as “Customer A” and was responsible for 37% of overall revenues. European revenues during the quarter were 46.4% of overall revenues. Who is this customer?

“Although we have more than 150 distributors, our largest distributor, who is a non-exclusive distributor for the United Kingdom and France, accounted for approximately 38.6% and 32.4% of our revenue for the years ended June 30, 2022 and 2023, respectively. On January 1, 2021, we signed a distributorship agreement with this distributor in our standard form, which does not provide any special terms or prices. “

Auditor recently sanctioned. MSPC, Certified Public Accountants and Advisors, A Professional Corporation was recently assessed a $30K penalty by the PCAOB for:

“failed to make and/or document certain communications with audit committees related to the planned participation of other firms and auditors in the audit, as required by AS 1301, Communications with Audit Committees.”

Profitability, regardless of sales trends, has been elusive. As long as the company has been filing financial statements they have been showing losses. Between the skinny 16.1% gross profit margins and the 18.2% they spend on operating expenses in the most recent quarter, net income is somewhere off in the distance.

Due to their miniscule gross margins and the possible disruptions that pop up during the ordinary course of business, distributors tend to trade at equally skinny valuations, be that price/sales or some other metric. While the company’s current $750M valuation doesn’t sound horrible next to the trailing $130M in revenues they’ve recognized, the chances the company is going to be able to show any real profitability over the next couple of years are rather small. Even if you assume they can get expenses under control and average maybe 15% of overall revenues and they can also manage to push their gross margins up to maybe 20%, that would leave you with a 5% net margin or 4% or so after taxes. For them to do, say, 50 cents a share under those assumptions which would translate to a 28x EPS multiple at current prices, the company would need to show $25M on the bottom line and over $600M in annual top-line revenues. Even if they managed to grow 40% a year it would take almost 5 years for them to hit that target, and that would only give them close to the 1x sales revenues most distributors would be happy to have.