My second and likely final mention of this name. Remember when I told you in my spiel yesterday that they didn’t “need” to raise any money?

Well, this morning, this recent IPO announced a $6M “special” divided to all shareholders, basically returning the entire proceeds from the IPO, just not to the people who bought them.

“J-Long Group Limited (Nasdaq: JL) (the “Company” or “J-Long”), today announced that its board of directors has declared a special dividend of an aggregate of US$6,000,000.00 out of the distributable funds of the Company, to be paid to all holders of record as of March 11, 2024, of its outstanding shares of common stock. The special dividend will be payable on March 12, 2024.”

Announcements of unexpected special dividends like this has a tendency to run stocks, especially if they’re recent IPO low-float Chinese stocks (GDHG anyone?). Running the stock, naturally, would help insiders who registered to dump 8.91M shares of stock on the offering be able to do so at higher prices.

What’s so special about it, US investor base? He’s giving you back your own money; rather, giving you a few pennies and placing the rest into his own (and other insiders) pockets.

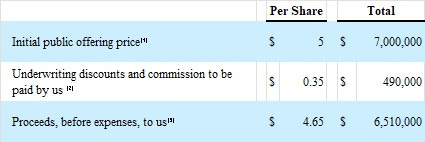

So of the $6.51M they received from their IPO, they are returning $6M of it back to shareholders only a month later. Ever see anything like that? From a Chinese company, no less?

Remember, they only sold 1.4M shares in the offering, and insiders own the remaining 30M shares, so the 20 cents or so per share the special dividend turns out to be, only $280K will make it back into non-insider hands, while the other $5.712M will make its way into insider pockets.

They’re not even trying to hide their disgust for you, and the SEC is unlikely to ever do anything about it.