Sometimes you just have to ask “where is the SEC?” when some of these foreign companies file to come public on US exchanges.

As I pointed out a couple of weeks ago, J-Long Group (JL) came public back on January 24th 2024 at $5 a share in a 1.4M share offering. In an unusual move, they also registered 8.9M pre-IPO shares for sale at the same time, allowing these early investors to cash out at any time should they desire to do so.

For the next month, the stock was bid higher on low to moderate volume, hitting a peak of $29 a share on February 28th, which is when I published a story and shared it with subscribers. On February 29th the stock collapsed to $2 in a 17M share trading day bloodbath, and it has continued its grind lower.

Fast forward to today.

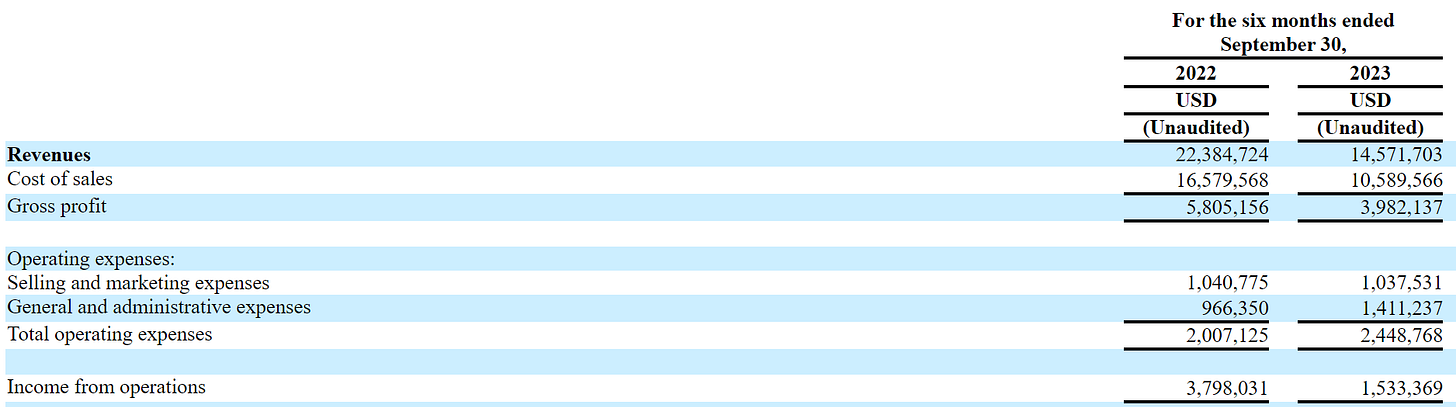

The company released a 6-K with a financial update for the first 6 months of their fiscal year, or through September 30th, 2023. Here are those results.

Revenues down 35% through September 30th, 2023, a full 4 MONTHS before the company went public in the US. I bet US investors would have loved to have know that before buying those shares.

Also part of the prospectus was the disclosure that on September 20th, 2023 the company sold 8.9M shares to six different entities for a total of (supposedly) $24M. That’s what they call “a show of confidence” in the company offering.

Taking a look at the September 30th 2023 balance sheet, which should include the proceeds from this offering, it seems strangely empty.

Where did those offering proceeds go? There should be $24M of cash laying around from the offering, and yet it has mysteriously vanished.

What we do have is an additional $5M loan given to the insiders from the company’s reserves, and those 8.9M shares the company handed out for nothing likely getting sold to US investors.

And to top it all off, this all happened 4 MONTHS before the company went public.

When you hear me (or rather read me) whine again and again about the endless stream of (primarily) Chinese companies listing their shares on US exchanges in a blatant scheme to pilfer money from US investors, examples like this is why I will continue to do so.

The US SEC can change the listing and filing rules for foreign companies in a heartbeat, but will not do it. They’re not there to protect you, folks, so use caution, and look after yourselves, and if you ever read the following lines in a prospectus, run in the opposite direction.

“Investors are cautioned that you are buying shares of a Cayman Islands holding company with operations in Hong Kong by its operating subsidiary.”