With the most recent set of (supposedly) audited financials dating back to March 31st, 2023, the underwriters over at Eddid Securities USA (nope, never heard of them until now) decided that now was the time to foist yet another Chinese (Hong Kong) company onto the backs of the US investor class. Seemingly unsatiated with busted deal after busted deal and the billions of dollars being siphoned out of US markets and into foreign hands, the US investor base is apparently only too happy to comply.

While this thing is a recent (January 28th) IPO and the company only sold 1.4M shares on the offering, they also registered 8.91M shares for selling shareholders in their prospectus. That’s at least somewhat unusual, and the reason why this may actually be worth your time to check out.

“1,400,000 Ordinary Shares par value of US$0.0000375 per Ordinary Share. We are also registering for resale up to 8,910,000 Ordinary Shares by the Selling Shareholders. These Ordinary Shares will not be part of this offering.”

It has the same structure as almost every other Chinese offering, in that US investors are buying into basically an empty and worthless shell called J-Long Group Limited registered in the Cayman Islands and not the actual operating company J-Long Limited Hong Kong, since, well, they’re allowed to take your money, but you’re not allowed to question it.

What do they do?

“We offer a wide range of reflective and non-reflective garment trims, which are mainly categorized into (i) heat transfers, (ii) fabrics, (iii) woven labels and tapes, (iv) sewing badges, (v) piping, (vi) zipper pullers and (vii) drawcords.”

How much were sales in FY 2023? Glad you asked…. $38,292,397. How about FY 2022? $38,292,412. Pretty uncanny, right? At first I thought I was seeing double. A revenue decline of like $15, or perhaps a few zippers. How does that even happen in a real company?

Do they make any money? Supposedly $6.6M in 2023 and $4.5M in 2022.

How many shares are outstanding? 31.4M

At a recent price in the $20 range (this thing moved a bunch today, and that part is important), this thing is worth north of $600M and trades for somewhere around 100x earnings (we are assuming this is all for real). Even at the offering price of $5 a share, this thing had a $150M valuation and traded for 30x earnings. For a zero growth Chinese garment sweatshop, no less.

So who owns those 8.91M shares that are being registered?

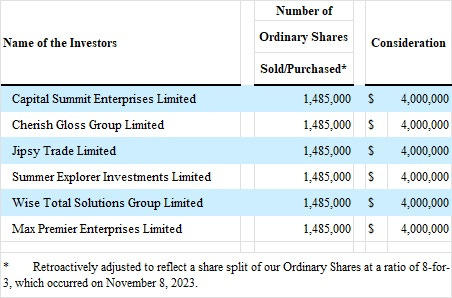

“On September 20, 2023, the Controlling Shareholder entered into individual sale and purchase agreements with the pre-IPO shareholders, Capital Summit Enterprises Limited, Cherish Gloss Group Limited, Jipsy Trade Limited, Summer Explorer Investments Limited, Wise Total Solutions Group Limited, and Max Premier Enterprises Limited. According to these agreements, the Controlling Shareholder agreed to sell and each of the pre-IPO shareholders agreed to purchase 1,485,000 shares (retroactively adjusted to reflect a share split of our Ordinary Shares at a ratio of 8-for-3, which occurred on November 8, 2023) of JL at a consideration of US$4,000,000. The shares were transferred on the same day upon execution of the instruments of transfer, with the consideration to be settled by way of promissory notes on or before June 30, 2024. The following table sets forth the breakdown of the foregoing transactions among the Controlling Shareholders and the pre-IPO shareholders:”

Notice the amounts. 1.485M shares for each. 1.485M/30M = 4.95%. The management and 5% shareholders are subject to a lockup of 180 days. These folks? Nope. Which is why all of their shares are getting registered immediately. But wait! Don’t think that they’re all greedy or anything, or are likely to be immediate sellers. They have a couple of holders willing to take one for the team (at least in part).

“Wise Total Solutions Group Limited, one of the Selling Shareholders selling 1,485,000 Ordinary Shares pursuant to the Resale Prospectus, has also agreed with the underwriters, not to offer, issue, sell, transfer, contract to sell, encumber, grant any option for the sale of, or otherwise dispose of, directly or indirectly, any of its Ordinary Shares or securities convertible into or exercisable or exchangeable for our Ordinary Shares for a period of two (2) months after the effective date of the registration statement. See “Shares Eligible for Future Sale” and “Underwriting” for more information.”

Set your clocks for March 28th folks.

Any others? Ever hear of a “leak-out” agreement? Very appropriately named here.

“Prior to the offering, Jipsy Trade Limited owned an aggregate of 1,485,000 Ordinary Shares, of which 1,485,000 Ordinary Shares are being registered pursuant to the Resale Prospectus. Jipsy Trade Limited’s right to sell those 1,485,000 Ordinary Shares is subject to certain resale restrictions based on a leak-out agreement, as well as any Rule 144 restrictions.”

Those restrictions?

a) Jipsy Trade Limited may sell up to 33% of the Relevant Resale Shares if (i) the Nasdaq Official Closing Price of the Ordinary Shares of the Company as reported on nasdaq.com (“NOCP”) on ally two consecutive trading days equals or exceeds 120% of the offer price per share in the initial public offer; and (ii) the average daily trading volume (as reported as the NLS Volume on nasdaq.com) (“Trading Volume”) of the Ordinary Shares on Nasdaq over such two consecutive trading days equals or exceeds 100,000 Ordinary Shares;

(b) Jipsy Trade Limited may sell up to an additional 33% of the Relevant Resale Shares if (i) the NOCP on any two consecutive trading days equals or exceeds 140% of the offer price per share in the initial public offering; and (ii) the average daily Trading Volume of the Ordinary Shares on the Nasdaq over such two consecutive trading days equals or exceeds 120,000 Ordinary Shares;

(c) Jipsy Trade Limited may sell the remaining 34% of the Relevant Resale Shares if (i) the NOCP on any two consecutive trading days equals or exceeds 160% of the offer price per share in the initial public offering; and (ii) the average daily Trading Volume of the Ordinary Shares on Nasdaq over such two consecutive trading days equals or exceeds 150,000 Ordinary Shares.

The rest of the holders? No such lockup or standstill agreements in place, just the standard 144 rules for any of them should they happen to be affiliates.

This thing didn’t need any money. They supposedly raised $24M from those 6 investors just last September, which is more than twice the amount of total equity the company had at the end of March 2023. Selling an additional 1.4M shares in this offering is going to do absolutely nothing for them. Sure, they have a section called “use of proceeds” that is standard in every prospectus, where they will use 30% for prospective acquisitions, and 20% for R&D, and 20% to increase warehouse capacity in their zero growth industry, and the rest to pay the costs of the offering, but that is all boilerplate.

This is yet another blatant example of foreign companies (typically Chinese) looting US shareholders in a very obvious and in-your-face fashion. Until the SEC decides to put an end to this nonsense, the looting will continue.