Among the renewable energy companies, MNTK is something of an odd duck; dually listed in both the US and Johannesburg, this US-based provider of renewable gas and electricity was brought public by the folks over at Roth Capital, not exactly a go-to name in the oil and gas space. Crappy tech and China space yes; oil and gas, not so much. The company itself was acquired by a South African investor group in 2014 that proceeded to cobble together the current portfolio of assets over the next few years, before coming public in 2021; now they apparently want out completely. A story in Bloomberg a few weeks back claimed that recently public MNTK was up for sale and cited the deal between CVX and REGI as proof that there is an appetite among the majors for expanding their footprint into more renewable sources.

https://www.bnnbloomberg.ca/montauk-renewables-explores-options-including-sale-1.1801047

While it is undoubtedly true that the majors are reducing investment in the exploration of fossil fuels and investing what they can to prove their renewable bonafides to a population that seemingly no longer appreciate them, the purchase of a MNTK just might cause a bit of indigestion to even the largest of companies.

The first issue one runs into would be regarding the price: REGI sold itself to CVX for $3.1B which is somewhere around 1x expected revenues of $3B whereas with 145M fully diluted shares MNTK trades for a much more fashionable 14x expected 2022 revenues of $220M or $2.5B. Book value? REGI went out for around 2x book while MNTK carries a similarly large 15x book value price. While most of the majors can absorb something like a MNTK without so much as a stutter, a 14x revenue and 15x book value multiple just may cause a bit of hesitation in even the biggest companies. EBITDA? Adjusted EBITDA in 2021 was around $28M, up from $26M in 2020 (plain old EBITDA was around $25M in each year), which puts that multiple into the stratosphere. Higher energy prices in 2022 are sure to increase that number, but not to the extent to make it seem like a rational purchase.

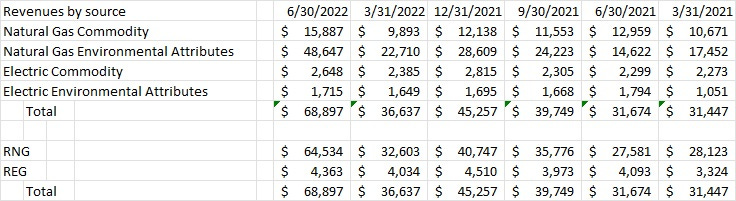

Then there is the issue regarding their actual business: REGI revenues come primarily from selling bio-diesel (70%) and associated RIN energy credits (20%) and other government handouts (10%) which would likely fit in somewhat nicely with what CVX is already doing. MNTK’s recent financials, on the other hand, show it to be almost fully dependent on the US government’s largess as a full 75% of revenues come from producing RIN energy credits with maybe 20% coming from actual RNG sales and 5% from electricity generation. The company is able to generate 11.727 RIN credits for every MMBtu’s that they generate, which is the conversion between the gallons of ethanol needed to generate an equivalent amount of energy as RNG. Now, that just might be purely what some company out there is looking to buy, or perhaps they can sell off the electricity generation and keep the rest, but looking at the spot price of current D3 RIN credits (they grade them based on the feedstock) and recent prices, then perhaps some company would be thinking that they’re hitting that 14x revenue multiple at a time when RIN credits are trading at all-time highs.

https://oilandenergyonline.com/articles/all/rin-prices-approach-all-time-highs/

https://rincrude.com/

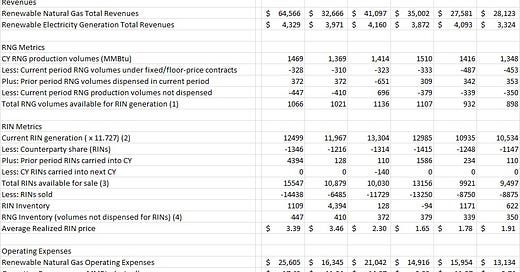

The reason they are trading at such a huge multiple is due to the RIN credits, no mistake about that. Actual RNG production year over year was up less than 4% while electricity generation was flat at 47 MWh. So if RNG production was up only slightly and electricity generation was flat, how did the company post a 110% year over year increase in overall revenues? Price increases, naturally, along with some delayed sales of RIN credits. In their RNG production the company is able to basically strip the RIN credits off of the actual commodity generated and sell those separately, while their electricity generation is done on fixed price contracts with the local municipalities where they operate (they operate 4 facilities, the largest by far being in SoCal). So as the price of natural gas has gone from $2.50 to $7.50 to now $9.20, the company has been able to profit from that rise, selling the commodity and stripping out the RIN credits and selling those for a nifty profit.

And that is precisely what happened in Q2. The company felt that during Q1 there was some temporary “D3 RIN index volatility” happening which prompted them to withhold around 4.4M RIN’s from sale and push them into Q2. Oddly enough, the average price they were able to derive for RIN’s during Q1 was $3.46 while during Q2 that declined a tad to $3.39. Either way, good call/bad call, the company sold 14.4M RIN’s in Q2 vs. only 6.5M in Q1, spiking their RNG revenues higher by 134% in the process.

And you know what’s kinda sad about that? Despite holding back revenues from one quarter to the next, the company still only earned 13 cents a share in Q2 after slightly losing some money during Q1. A huge beat like that usually prompts companies to adjust their outlook, but their full-year 2022 outlook didn’t change either, with estimates for RNG revenues for the year ranging between $200M-$220M vs. the prior expectation of $181M-$226M. The RNG production range was actually lowered to 5.6 to 6.3 MMBtu’s from 5.5 to 6.7 MMBtu’s, and the top end of the renewable electricity production range was also cut. As you can see from the chart below (Q4 numbers are not provided by the company in filings, so they may be a bit squishy), production volumes have been relatively flat as the company has only managed to increase production marginally on their existing properties.

Which leads to the question: why isn’t the company increasing their production in order to better profit from the rising tide of commodity prices? The answer is simply because 11 of 12 of their existing RNG facilities and all 3 of their REG facilities is located on a municipal landfill site where they process environmentally detrimental methane (biogas) into RNG products. The remaining site is located on a dairy farm where they process cow poo and turn it into RNG. In either case, they process the RNG from the landfill with the purpose of either selling it outright or using it as a feedstock in the generation of electricity. Also the company doesn’t own any of the properties on which they operate, they only have long term agreements with each of the municipalities or agencies where they locate their machinery and equipment and, in the case of REG, long-term purchase agreements with local utilities. So unfortunately they can’t simply drill more wells in order to increase production and take advantage of attractive commodity prices; it’s not that simple.

If an oil major is looking at something like a MNTK, then there would certainly be an air of desperation in that decision. They wouldn’t be purchasing any real estate, no drilling rights, no reserves, or even anything with the potential for increased production. They would simply be purchasing the machinery and equipment the company has on each of the landfill sites used to extract and process the methane or biogas and turn it into pipeline-quality RNG, or, in the case of their REG facilities, generate a small amount of electricity and sell it to the local utilities. All of their agreements and contracts are long-term, and some of their relationships go back 50 years, so there isn’t really any fear that they will lose or shut down any project imminently, but each contract is fairly limited in scope and terms of what they can and cannot do on that property. As it is, anyone stepping up and buying MNTK would be getting $320M of PP&E and some long term production agreements, but not much else.