There have been plenty of crappy Chinese reverse merger into a defunct US-based-and-listed NASDAQ shell, but this is the first I have seen where the defunct NASDAQ-listed shell is from a fellow crappy Chinese company. Those folks over at Bain aren’t ones to let something valuable like a listing go to waste. The original company, RISE Education Cayman Ltd., came public back in 2017 in a $100M IPO with Bain Capital as a major (seller) sponsor. Despite some impressive Wall Street backing (Morgan Stanley, UBS, and Credit Suisse led the IPO), likely due to Bain’s involvement, neither the company nor the stock ever really caught much traction. In 2020 of course COVID hit, the stock got crushed along with plenty of other names, and they started thinking about their options. Bain Capital still owned like 80% of the shares and purchased most of what was left of the educational operating assets at the end of 2021, leaving the markets with basically a worthless Chinese shell. Along comes Dada Auto Inc., a money-losing subsidiary of fellow Chinese company Newlinks Technology. We are told Dada is “a leading operation and technology provider serving China’s electric vehicle charging market.” And just like that, shares of RISE are given a second wind. During the reverse merger the old shareholders only held on to 7.1% of the “new” company, but at least it is something.

NaaS Technology Inc. (NAAS - $5.44)

ADS Shares Outstanding: about 220M

If you take a look at the company’s publicly filed presentation, they call themselves a “one-stop solutions provider empowering electric mobility.” Some other buzzwords coming from the presentation include utilizing “capital light growth with minimal capex needed to scale business.” So if an office building wants to set up a charging station in their parking lot, they can hook up with somebody like NAAS, who will “procure charging hardware and software” and even arrange for potential financing should that be a concern. They will then help that client acquire users to come charge at their location, and service any of the chargers should something go wrong. As time goes by, they want to stick with the client and assist with battery swaps, set up virtual power plants, further energy or storage procurement, and even hydrogen fueling solutions should that ever take off. So while they actually make nothing, from the chargers to the batteries to the storage to the fuel cells to the equipment needed to connect the charging stations to the grid, yet they nevertheless bill themselves as a “turnkey EV charging solution” provider.

Ownership and Shares Outstanding – According to the 20-F filed on June 10th, the day the reverse merger into a shell was completed, Newlinks Technology Ltd. was the owner of about 249M class B shares and 1.4B class C shares of NAAS which gave them 76.9% ownership and 88.7% voting power over the company. The NAAS CEO is Wang Yang and the Chairman is Dai Zhen, each of which lists themselves as a co-founder of both NaaS Technology and Newlinks Technology (which they founded in 2017). Bain Capital was able to parlay their prior stake, which this press release indicates was worth $17M at the conversion date, into 138M class A shares and 278M class C shares for a 20% ownership position in the new shares of NAAS. At a conversion rate of 1 ADS for every 10 ordinary shares, Bain owns somewhere around 31.6M shares of NAAS; private equity always manages to come out unscathed, don’t they? In order to keep a better eye on their investment this time around, it was announced at the end of the year that Bain Capital alum Alex Wu would transition into the role the new NAAS CFO after the prior CFO’s unexpected and immediate departure for “personal reasons.” On December 1st the company announced that they had privately placed 57.57M ordinary class A shares at $0.5211 per share (or $5.211 per ADS) for a total of $30M. Since this is one of those companies that only files some sort of a statement regarding their financials every 6 months, and assuming there are no other shares that have been issued since, there should be somewhere around 2.2B class A, B, or C ordinary shares outstanding, which should be the equivalent of 220M or so ADS’s.

Options – The co-founders Zhen Dai and Yang Wang awarded themselves 112.33M and 37.44M, respectively, options on the ordinary shares prior to the company’s debut as a public company as a result of a reverse merger. The exercise price of $0.000003 means it will cost him a grand total of $337 and his co-founder Yang Wang $112 to convert the options into the equivalent of $70M and $23M worth of NAAS shares, respectively.

Balance Sheet – at the end of December 2021, after Bain “acquired” most of the educational assets and management “acquired” some of the others, the company was left with something under $5M in total assets, and about half of that was due from related parties. Fast forward six months post-reverse-merger, and the newly formed publicly trade NAAS has $89M in total assets, $62M of that in cash, $23.5M in “prepayments, other receivables, and other assets,” and only $82,000 in anything resembling PP&E. All of their facilities are listed as office space, and nothing is designated for manufacturing. They had also already burned through $157M in shareholder capital on their way towards accumulating less than $5M in net revenues since the company’s inception.

Revenues – While the company breaks down revenues into a couple of main categories including “Online EV Charging Solutions” as opposed to “Offline EV Charging Solutions,” the company also believes that there will be some sort of “recurring” source to their revenues and explain that over a 10-year period of time they expect one-time category revenues to make up approximately 35% of the overall number while recurring revenues will make up the other 65%. The company of course has only been in business for a few years and has no idea if that will ever come to pass, but they are savvy enough to know that “recurring” is a good buzzword to throw in front of US-based investors.

Online EV Charging Solutions – “The Group offers effective mobility connectivity services by a platform to connect charging station operators and end-users to facilitate the completion of successful EV charging. The performance obligations for the Group is to present the charging stations and charging piles on the platform, and provide such information for end-users who visit the platform, they could select charging stations and charging piles on their own. Upon the completion of an EV charging order, the Group recognizes the service income charged to operators and end-users. The Group provides services to both charging station operators and end-users according to agreements, and the Group performs its obligations for both parties during one transaction, both charging stations and end-users are regarded as the customers of platform services. The Group has determined that it acts as an agent in the online EV charging solutions services as (i) the Group does not obtain control of the services prior to its transfer to the end-user; (ii) the Group does not direct charging stations to perform the service on the Group’s behalf, (iii) the Group is not primarily responsible for charging services provided to end-users, nor do the Group has inventory risk related to these services, and (iv) the Group facilitates setting the price for charging services, however, charging stations and end-users have the ultimate discretion in accepting the transaction price and this indicator alone does not result in controlling the services provided to end-users.”

Offline EV Charging Solutions – “The Group offers offline services to charging station operators related to their operations, including operation of EV charging station, hardware procurement, electricity procurement. In case the Group leases certain EV charging stations and operates the EV charging stations on its own discretion, the Group has determined that it acts as a principal in the services as the Group is primarily responsible for providing the EV charging service to EV drivers. The Group provides charging services based on orders from its own platform as well as other third-party’s platforms. Also, the Group has full discretion in establishing service fee rates for the charging services to customers. EV charging fee includes electricity bills and charging service fees. EV charging service fees received/receivable by the Group under such instances are recognized as revenue on a gross basis when the service is rendered. The electricity bills received will be remitted to the electricity providers and are recorded to deduct prepayment to the electricity providers. For the hardware procurement services, the Group procures charger piles at bulk purchase prices from charger manufacturers and re-sells these charger piles to charging station operators at discounted prices. The Group has the discretion on prices, but the Group does not control the hardware during the transactions since the orders are on demand basis to the charger manufacturers. For the electricity procurement, the Group negotiates with State Grid for favorable prices, and charges charging station operators for a take rate on the procurement value, while the Group does not control the electricity before the service delivered. Therefore, the Group recognizes revenue of hardware procurement and electricity procurement on a net basis upon the completion of the transactions.

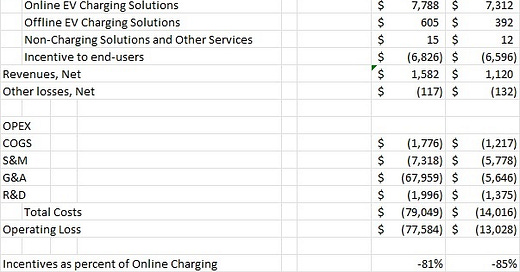

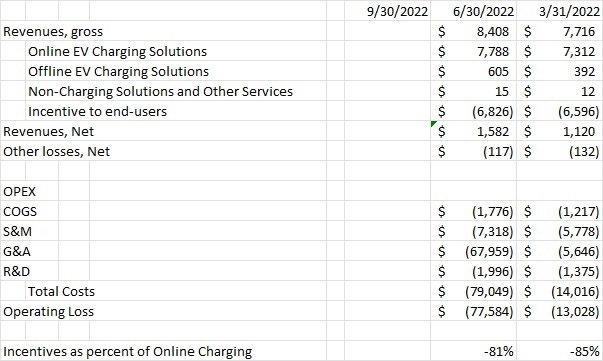

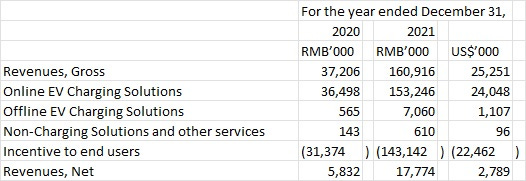

Why no Q3? Take that up with the SEC and their idiotic reporting rules for certain foreign filers. We do know from prior filings that revenues do appear to be heading in the right direction, but the gross revenues overall Q1 to Q2 increase appears to be a fairly small 9% gain compared to the “net revenue” gain which shows a 41% increase. That should be good, right? Well, not so fast. The “offline” revenues component is basically revenues they achieve for fully servicing 73 charging stations, so there is no “incentive” component loss associated with those revenues; the “incentive” rebates are tied to the “online” revenue component, which slowed dramatically. By comparison to what they showed in 2020 vs. 2021, the gross revenue number (in RMB) for 2021 vs. 2020 is 160M vs. 37M while the net number is 17.7M vs. 5.8M, so while 2021 was much better than 2020, the numbers in dollar terms remains rather small.

Incentives to end-users – The seemingly unending flow of money in our system has created numerous business models that will never make any sense, and NAAS is no exception. The company needs to throw some incentives at potential customers in order to induce them to utilize their services, and in the case of NAAS, those incentives are quite large. Gross revenues in the most recent quarter were $8.4M while net revenues were only $1.6M; the difference between the two is the amount of incentives the company has to offer in order to induce end-users to utilize their charging network, or greater than 88% of their “online” revenues. And to top it all off? That may not be the full extent of the incentives that they have to offer. As the company explains in the following section, there are times when the company actually gives customers money in order to utilize their services, and if they do, those amounts are charged to S&M rather than presenting a negative revenue number.

“Incentives to end-users represent discounts and other subsidies offered to end-users to encourage the use of platform relating to our online EV charging solutions business. NaaS records such incentives to customers as reduction of revenue, to the extent of the revenue collected from the customers. In certain transactions, incentives offered to the end-users exceed the revenue generated from the relevant transaction, in which event the excess payment is presented as selling and marketing expense instead of negative revenue.”

S&M costs in each quarter are far in excess of whatever the net revenue number winds up being, which means the company just might be buying revenues simply in order to build out some sort of a charging network, all the while hoping that at some point (preferably before the cash runs out) those higher margin “recurring” revenues will kick in and save the company.

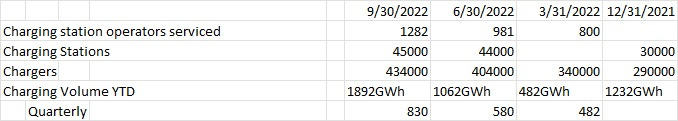

Recent metrics – while the company did not announce Q3 results, they did update some of the metrics which they add to the end of their press releases. At the end of those, they highlight things like “charging station operators serviced” and “charging stations” and “chargers” and “charging volume” to show that they are growing. In their most recent press release announcing their new CFO they announced some updated Q3 metrics which appears to show them picking up a bit again. Again, the numbers are rather spotty. In the 20-F they mention metrics for both December 31st 2021 and March 31st 2022 throughout the report. Press releases up to close to the end of the year usually mention only 2021 year end results, so the numbers are not complete.

Guidance – the company guided a couple metrics on their Q2 announcement, expecting charging volumes to hit 2700GWh for the year and the value of charging piles sold to be 130-150M RMB. Through Q3 the charging volume was 1892GWh, so to hit the number they just needed a repeat of what they did in Q3, which would be flat but would be fine. Through Q2 the value of charging piles sold was only RMB17.8M, so hitting RMB140M or so would sound pretty aggressive, which would mean a total of RMB120M through the back half of the year or about $17M worth of chargers.

The link to Newlink Group – Newlinks Group is the Bain Capital-backed parent to NaaS and apparently operates something like the GasBuddy app we have here in the states and, according to Crunchbase, has raised over $645M in investor capital so far. In a press release from 2021 announcing a $200M fundraising round led by Bain Capital and this slightly more recent announcement regarding their new-found “unicorn” status and an undisclosed capital raise, Newlink describes their offerings and services thus:

“Founded in 2016, Newlinks is a fast-growing online technology platform that helps match drivers in China with the best gas stations and charging piles. The company's solutions also help both gas station and electric vehicle charging station owners drive incremental sales, reduce procurement costs, manage operations and grow profits.”

Like I said, it’s basically a GasBuddy app. Out here in the states, the word “best” is usually replaced by the word “cheapest,” but perhaps some other factors go into the model such as distance and, especially for “charging piles,” the expected wait to service. Due to the density of housing and the lack of private parking, apparently most of the charging in China happens at public locations. Something else that may be part of the formula for directing cars and their drivers to the “best” service location could be the relationship between NAAS and the service station; wouldn’t it be great if NAAS customers would be able to jump to the front of the line on related-party Newlinks’ app and direct more business to them than perhaps would ordinarily be warranted? Oddly enough, though you would expect there to be some sort of disclosure regarding the parent company steering customers for any reason to a subsidiary company for their charging needs, there is no disclosure regarding related party revenues between the two companies.

Headcount – seems like a rather petty quibble, but at the end of March 31, 2022 the company lays out a table that says they have 222 full-time employees and 80 outsourced personnel. The 222 employees are all either R&D or Administrative or corporate, so the other 80 outsourced must be responsible for something else. What can that be? They also say that some of their customers love them so much that they were allowed to take over the day-to-day running of 73 different stations for 11 station owners in exchange for some sort of a “fixed amount of pre-agreed fees to the station owner.” They also get to keep 100% of the revenue as their own according to the filing, which should have the result of juicing up the revenue number though, as we know, the margins on that business are less than skinny. 80 people to run 73 service stations seems like a bit of a stretch.

Math is fun – while the revenue numbers all look rather small, the number of chargers that they have out there appears to be rather large. Doing some fun math, if you divide the second quarter’s gross revenues of $8.4M by the average number of chargers they had during that quarter of 372,000, you have each charger doing a whopping $22.50 worth of business for the company for the entire quarter. Or here’s another good one. At the end of December 2021, the company gives us this little tidbit and says in their presentation that they have served 2.2M end-users cumulatively. At the end of 2021 they had 290K chargers installed, while at the end of 2020 the number was 165K. If you were to just take the average number of chargers for the year, or around 238K chargers, and divide them into the 2.2M total users serviced going back to their earliest beginnings, but pretend it was just for the year, then that would mean each charger was used fewer than 10 times inside the entire year, or less than once a month per charger. Doesn’t really sound like there should be long lines for charging your new Tesla in China, but perhaps they all want to charge their cars at the same time? Without more numbers it’s hard to see which of the metrics correlates the best and will eventually be the best by which to judge the company’s actual progress and revenue growth, but if Q2’s 19% sequential charger growth only translated into 9% revenue growth, then Q3’s 7% sequential charger growth may not be a great sign for the rest of the year.

Valuation – domestically you may have a comparison with something like a CRGE which constructs charging locations to something like BLNK which provides their own chargers along with also having some company-owned charging facilities. Each company had their moonshot moments but has since come back to earth, sporting $350M and $800M market caps, respectively, but neither is exactly a comp for NAAS. A better comp may be something BLNK recently purchased called SemaConnect, for which they paid something over $200M and contributed almost $9M in revenues in their most recent quarter (and without the subsidies!!!!). That would be something comparable in size to NAAS, but at a fraction of the valuation.

I know this whole electrification thing is really hot and still in its infancy and companies are still trying to figure out how they will be able to cash in on this whole movement. There also are not all that many ways for investors to play the transformation so something like a NAAS might get attention that isn’t really warranted. For many companies, be that an UBER or LYFT out here in the states or a NAAS out in China, the current business model includes a huge transfer of wealth from shareholders to, in this case, Chinese consumers in order to induce them into using a particular set of chargers that they might otherwise not choose. Now, perhaps the NAAS chargers are all located so far outside the city in the boondocks that the only way that they can entice anybody to use their services is to basically give away the electricity and hope they can make it up somehow on the back end (maybe providing really expensive coffee and donuts while they’re charging their cars), but giving away your only reason for existing is not a real long-lasting business model.