How many times do you run across a company where not only a board member but also an advisory board member have each been defendants either in civil or class action cases while on the board of directors for another company? In this board members case, he was a defendant three different times for three different companies (all Chinese, btw) that ended with settlements in the hundreds of millions of dollars. The advisory board member, their banking expert, was individually named in a suit for “breach of fiduciary duty” and “usurping corporate opportunity.” Crazy, right?

When you’re a young company in the process of filing that paperwork for your IPO and you’re out there searching for and picking out qualified candidates for your board of directors or advisory board that will suitably impress your future investors, don’t you just tell either your underwriters or the search company you hired to help fill out some keys spots that perhaps it’s best to avoid folks like that? Really, what recent IPO would want that kind of a distraction? Unfortunately the underwriters here are R.F. Lafferty & Co. and Revere Securities, and they never gave the management over at Richtech Robotics (RR) that particular corporate governance memo.

Though CEO Zhenwu (Wayne) Huang says in his bio that he founded Richtech Robotics back in 2016, an entity search under the state of Nevada’s corporate listings says the company wasn’t formed until June 18th, 2022. His bio also states that he ran Richtech System Ltd. from 2007 to 2016 (no gap in the old resume for him, folks!), but once again, a Nevada corporate search says Richtech Systems Ltd. was dissolved on June 7th, 2012. Both filings are theirs, for both he and his brother show up as officers in both of these filings. Prior to that he supposedly ran something called Nanjing Rich Digital Technology from 2003-2007, where at some point he supposedly had over 100M subscribers for his live, interactive TV games.

His brother Michael has a degree in business and economics, while he supposedly has one in “computer information management.”

Originally filing to come public in August 2023 in a $22M IPO with Pacific Century Securities as their sole underwriter, it took them a few extra months along with a change (upgrade perhaps?) in underwriters before finally coming public just before Thanksgiving. It is true that the recent IPO was only for a meager 2.1M shares (plus 315K greenshoe) at $5, though there are over 20.2M “B” shares and 44.3M “A” shares outstanding post-IPO giving this thing a market cap north of $500M.

There is a 180 day lockup, and there are only a limited number of shares available to trade, but worth watching should something change in the future.

This spiel was originally going to be a short blurb because of the liquidity constraints, but it sorta grew as I added more bullet points, and the result is what lies before you.

What do they actually do? Their website shows off the robots that they have available, including a serving robot named Adam, delivery robots named Matradee, and cleaning robots named Dust-E. All are for commercial or industrial users rather than for the average homeowner, with their primary targets being in the food services and hospitality industries. So their robots mainly cart away or deliver either dirty plates or plates of food, while their cleaning robots are basically industrial-strength Roomba’s. The ADAM can supposedly mix cocktails and drinks, though a soda fountain does much the same thing. They do have a boba tea drink location set up, along with a location in Caesar’s that mixes some drinks. This article has some links for both Richtech and a dozen of their competitors all doing much the same thing.

Patents. They claim to have 7 patents pending currently, and if you look up each of their numbers 17549815, 29790385, 29790387, 17817639, 29846011, 29791849, 29836627 on the USPTO website, only the first one pops up, and it has Zhenwu Huang as the inventor. The other 6 give back no search results found. Perhaps I’m doing something wrong, but it’s highly odd that the first query pops right up and the other 6 come back blank.

When only the best will do. So you managed to convince a former McDonald’s COO to act as an advisor, and you even managed to snag a former MGM gambling honcho to sit on your board of directors, but what other quality people can you get to round out the team?

Turns out Richtech Robotics director Stephen Marksheid has been a busy boy throughout his investment career. Besides RR, he currently sits on the board of directors of former Short Ideas favorite and current Chinese insurance outfit Fanhua Inc. (FANH); Jinko Solar (JKS), a perennial Chinese favorite among the naysayers; Hong-Kong-based Kingwisoft Technology, currently trading for 2 cents in Hong Kong; along with a spate of future SPAC’s, all still around $10, including MCAC, FORL, and TRIS (given his choice of companies to support, it is likely worthwhile to follow them should any of these SPACs find a partner for merger). His involvement with China Integrated Energy in early 2011 (CBEH at the time) (“Mr. Markscheid was a defendant in his capacity as a director of China Integrated Energy, Inc”) was due to “disseminated materially misleading statements and failed to disclose material information concerning the CBEH’s true financial condition.” JKS came right after (“Mr. Markscheid was a defendant in his capacity as a director of JinkoSolar Holding Co. Ltd”) in 2011 and then in 2012 he was a director for ChinaCast Education (“Mr. Markscheid was a consolidated defendant in his capacity as a director of ChinaCast Education Corporation”) which resulted in over $200M in settlements for a variety of issues, including “transfers of $120M to certain officers and directors” and “breach of fiduciary duty.”

Ms. Yman Vien (the lawsuit spells her name out as Yman Huang Vien, and though she is not listed as related to founding brothers Zhenwu Huang and Zhenqiang Huang, it does make one wonder) is an advisory board member and currently holds the position of VP business banker at Lakeside Bank and has been “recognized by the American Bankers Association.” She was also sued by the Chinese Consolidated Benevolent Association (CCBA) for basically setting up a copy-cat company with a similar name and logo (Chicago Chinatown Bridgeport Alliance – CCBA-SC) when she was president of the original CCBA’s board of directors. This came about in 2021. (I was thinking of setting up a fast-food burger place called McDoug’s and the logo would be a giant golden M against a red background. People would just call it Mickey D’s. You think McDonald’s would mind?)

When Google is one of your biggest suppliers… From their filings, here’s a list of their biggest suppliers.

In 2022:

“Currently the largest supplier, SUNWING INDUSTRIES LIMITED, provided $461,454 in materials in 2022. The second largest was Google, with a purchase amount of $213,285.64 in 2022. The third was ICEKREDIT, with a purchase amount of $205,000 in 2022. The fourth was UFACTORY TECHNOLOGY (HONGKONG) Co., LIMITED, with a purchase amount of $120,572.5 in 2022. The fifth was FedEx, in 2022 with a purchase amount of $107,767.14.”

In 2023:

“Currently the largest supplier, SUNWING INDUSTRIES LIMITED, provided $486,284 in materials in 2023. The second largest was NANJING YUDINGXIN ELECTRONIC, with a purchase amount of $80,900 in 2023. The third was UFACTORY TECHNOLOGY, with a purchase amount of $71,500 in 2023. The fourth was MINGSHILI INTELLIGENT SYSTEM, with a purchase amount of $70,700 in 2023. The fifth was ARO ROBOTICS, in 2023 with a purchase amount of $69,613.”

Click on some of the links I have provided. Sunwing apparently makes artificial grass and hedges, which is kinda interesting given RR is supposedly a robot maker. IceKredit is for payment services. UFactory, if you look at their site and compare it to the Richtech Robotics site, apparently made their ARM robot. Google and FedEx need no introductions.

COGS for RR in 2023 alone were $2.7M and these numbers don’t add up to more than $800K, so something appears to be missing.

Filing timely financial information is hard.

“The Registrant is unable to file its Form 10-K for the year ended September 30, 2023 within the prescribed time period without unreasonable effort or expense because the Registrant’s accounting staff needs additional time to prepare the financial statements for the period ended September 30, 2023 and the Registrant’s independent registered public accounting firm will need additional time to complete its audit of such financial statements. The Registrant anticipates that it will file its Form 10-K within the fifteen-day grace period provided by Rule 12b-25 of the Securities Exchange Act of 1934, as amended.”

Minimal revenues, maximum effort. They signed deals with a couple of bigger names, and have so far booked limited revenues from each: $9,000 from the lodging chain, while the casino operator was worth $306K. Any bets on who the lodging or casino operator might be? Director John Shigley, as it turns out, was the honcho at MGM Grand Hotels, so my money is on them.

“In 2022, we executed a Master Service Agreement (“MSA”) with a major hotel brand with over 5,000 properties worldwide. As of September 30, 2023, we have begun a nationwide rollout of our products to this customer’s hotel locations under this MSA. We also entered into an MSA with one of the nation’s largest restaurant chains with over 2,000 locations in the United States. As of September 30, 2023, we have received a lease order of $9,000 under this MSA. Additionally, we entered into an MSA with one of the top casino companies in the United Sates. As of September 30, 2023, we have recognized $306,914 in revenue under this MSA.”

“ Percentage of sales attributable to our enterprise customers in fiscal year 2023 and 2022 were 3.82% and 2.06%, respectively.”

Odd to think that less than 4% of all their revenues are coming from companies that they have these signed deals with, which would mean that 96% of their revenues are coming from these one-off types of sales.

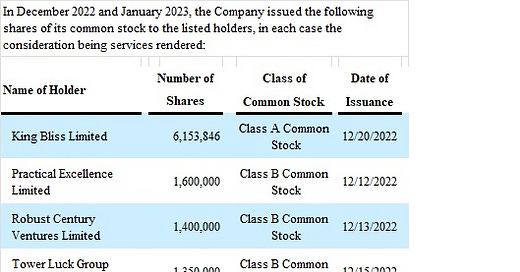

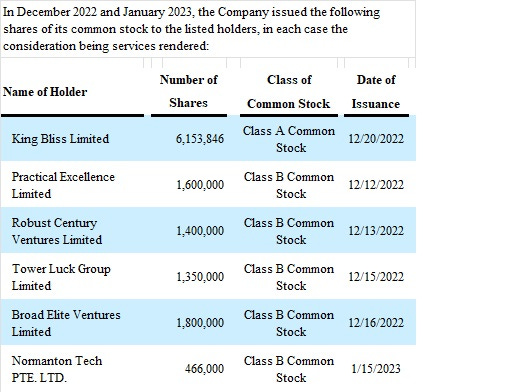

Paying for services with stock.

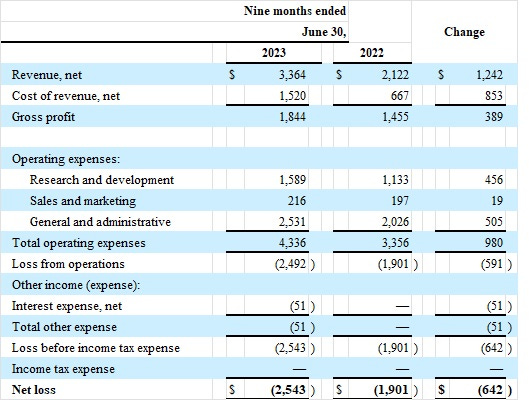

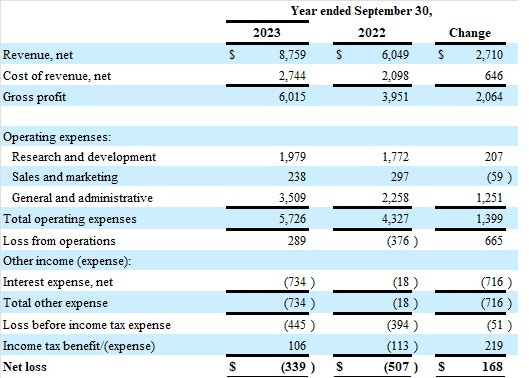

Talk about back-end loaded. Who knew the sale of robotics equipment was a seasonal type of purchase? What else do you call it when up to 60% of your annual revenues come from a single quarter? Better yet, since they’re on a September year end, it’s not even one of those calls to blow out the budgets before the end of the year rolls around types of quarters. It’s just a regular September quarter. And it didn’t just happen once…

In each FY 2022 and FY 2023 they went into Q4 with, respectively, 35% and 38% of what would turn out to be their total annual revenues.

Accounts receivables naturally took a bit of a jump. At the end of June 2023 A/R stood at $1.726M while at the end of September they had jumped to $5.576M for a $3.85M increase.

Enviable gross margins in a margin-constrained industry. 68% gross margins should be the envy of every company in the space (IRBT has one in the 30% range). Unless their “other” revenues (service, leasing, and other stuff add up to 35% of total) carry incredibly robust margins, their ordinary “product” revenues carry margins that are ridiculously high. Considering they don’t manufacture anything, it’s all imported from China, and at most they do some assembly and software installation, those are ripe for a fall.

Redundancy or something else? They had 51 employees before the quarter started, and they had 51 employees at the end of the September quarter. Crazy to think that your employees are only handling $3.3M in revenues for the first 9 months of the year and then an additional $5.4M in the final quarter of the fiscal year. No additional hiring. No large influx of inventories heading into the quarter. You employees handle triple the order flow, get all the parts shipped to them from China, get it all out to the rest of the country, all within a single quarter, just like the champs that they are.

I’ll take that! When the CEO transfers ownership of corporate assets to himself, it always makes for a bullet point. Prior to becoming a food service and lodging robot play, these folks were apparently a (drum roll please!!!!) COVID-19 play. They used to have a subsidiary called Uplus Academy LLC as part of their business, and that supposedly sold a robot that screened people (at a safe distance, of course) for temperatures. In 2021 this subsidiary supposedly did around $5M in revenues, but they decided to focus their attention on other uses for robots afterwards (I’m sure the decline in COVID sales had nothing to do with it) and they basically transferred that business to the CEO for $126.9K.

There are likely a few more bullet points in the filings, but given the lack of liquidity, i’m not sure how much more work to do at this point. Should the stock hold up into the coming lockup expiration, perhaps that will be the key.

Quite a few questions about these folks and, as of yet, not very many answers. Perhaps we’ll find more as they settle in to the grind of being a public company.