This is a recent reverse merge into a SPAC company, so not sure about how the borrow might be, but thought this little tidbit was interesting enough to pass along. Though trading a tad under the $10 merger price, it still has a billion dollar plus valuation for what’s mostly a science project.

Much like IONQ, the folks at RGTI are in the quantum computing as a service business (QCaaS). In the case of IONQ, most of their revenues came from a very small number of customers (like 2) which happen to be related parties that are also large owners of the company’s shares of stock. Turns out that RGTI has a similar issue.

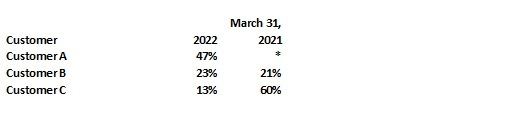

In the most recent quarter, the company derived over 83% of their revenues from only 3 customers, the same 3 customers that were responsible for over 81% of revenues in 2021. Is that considered progress? Customer C’s revenue declined by almost $1.2M, while Customer A increased theirs to almost $1M So their quantum computing services must be catching on? Not so fast.

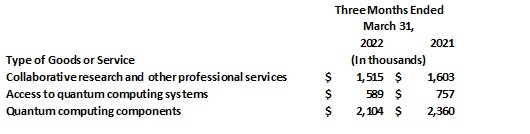

Overall revenues were actually down a bit from last year, but the breakdown shows that the majority of the revenues come from “collaborative research and other professional services” while less than 30% come from actual quantum computing services or the QCaaS. Government entities were responsible for 76% of overall revenues in 2022 and 77% in 2021.

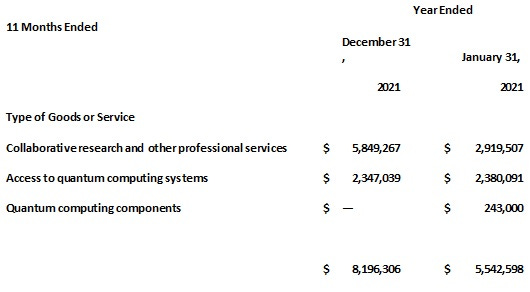

We find much the same situation for the recently restated annual numbers. Collaborative research once again provides the bulk of their revenues, while actual access to their quantum computing services placed a growingly distant second place. An odd point is the terminology “quantum computing components” that in the recent 10Q simply equates to a “total revenue” line, while in the annual number sketched out below, it was used to signify something else entirely, while the description in both filings remains the same (“Revenue is primarily derived from our contracts that provide access to our quantum computing systems, collaborative research services, professional services, and the sale of custom quantum computing components.).

On an annual basis, revenues appear to be heading higher from 2020 to 2021, which may explain why they chose to do their SPAC before their disappointing quarterly numbers came out. Once again, revenues are concentrated between a small number of customers, with government entities responsible for 51% and 59.6% of overall revenues, respectively. Government revenues are typically fairly safe, but as the company notes in their filings “ we anticipate lower-than-expected new government contract opportunities and what we believe to be slower than anticipated timing of government funding and appropriations with respect to relevant projects in 2022.”

So why am I bothering to point this out? 76% of recent quarterly revenues came from government agencies, and the company expects this revenue stream to pull back, as has already happened in Q1. Government agencies have been the prime source of revenues for these folks and any pullback can have some meaningful consequences. Other sources of revenues outside of government have to be able to step up, but the company has relied on the same 5 basic customers for almost all of their revenues for the last couple of years, so finding new customers even in the best of markets appears to be a challenging endeavor. That all could spell some trouble for growth in the coming quarters.