I’d been kicking around and browsing through filings of these folks over the last few days and trying to decide if I really wanted to put some thoughts together about it. Not that I didn’t think that it was going to be a great idea, but rather I don’t really want to get typecast (or maybe pigeonholed is a better word) as the guy who only does ideas on crappy Chinese names, since I consider that as only a part of what I do. Since starting this new Substack blogging effort on October 1st, a couple of my new ideas have been on real companies (the ill-timed ROVR and also COCO) while a couple have been on Chinese names (GDHG and ISPR). Historically, a 50% mix is not the percentage I tend to follow, and anyone reading this can look through my uploaded history and find plenty of “real” companies I’ve highlighted.

Then this morning comes around when supposedly 15M shares of GDHG suddenly became available for trading (and shorting) and that apparently opened the floodgates. Though the stock opened up relatively flat, a constant selling drone throughout the day just decimated the shares. By the end of trading, shares of prior idea GDHG closed down around 90% (after naturally being up almost 100% since first pointing it out on October 16th…) and that reaction alone nudged me into putting down some thoughts on this thing as well (btw, this 90% drop has gotta be one of the bigger single-day declines, absent any bankruptcy filings, of any name I have done). Nonetheless I can’t seem to stop myself from browsing through the financials of the crappy Chinese companies that seem to be increasingly popping up on my screens.

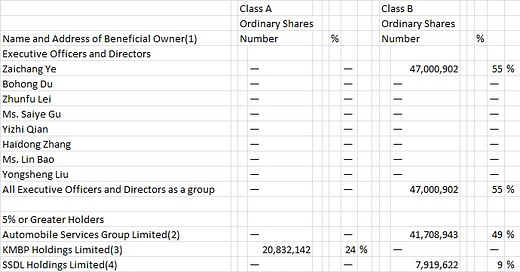

Today’s exhibit is SunCar Technology Group Inc. (SCA - $8.24), a stock that has the distinction of not only being a crappy Chinese name, but also being the subject of a SPAC merger earlier this year with something that was briefly called Goldenbridge Acquisition Limited, a BVI entity that was looking for a suitable host (GBRG was originally brought public by Maxim, which until recently was supposed to be sold to former idea Freedom Holdings (FRHC)). Now before your eyes glaze over, according to the official NASDAQ page on short interest, there appear to be under 100K shares of this thing short out there and, if their numbers are to be believed, this thing actually trades, on a 6-month average, over 1M shares a day. With no analyst coverage that I can find and no institutional holders of note, I’m not quite sure who’s buying it, but those are nevertheless the official numbers. As far as the float goes, of the 88M or so shares currently outstanding, something over 15M are supposedly in the float, which sorta jives with the decent volume numbers (I get around 18M shares in the float, but who really knows). I get that nobody likes to be tempted with great stories only to find that the stock trades by appointment or has an incredibly small float or a non-existent borrow: I am fully guilty of pointing many of those names out. However, I would point out that this name doesn’t appear to be like some of those, so please read on.