My annual report card is basically where I get to make the pitch to folks to either continue their support of my efforts or to perhaps initiate some support. Since this is my first report card since my format and distribution change, it will mainly be used for the latter, so I will expand it a bit to include some comments about past years as well. Also, I thought I’d switch things around a bit and show the chart first and then provide some commentary. Included for the first time, by the way, is an effort to calculate a holding period return (HPR) on the ideas.

The HUGE disclaimer applies here: I do this all for fun. This is in no ways a guarantee of future returns and should not be construed as investment advice. As always, I hold absolutely ZERO position in any of the names on any of my lists.

I tend to judge the performance of my ideas on an absolute basis rather than against any sort of a benchmark or index, but if I were forced to choose, my names would likely line up better against something like a Russell 3000 than against the S&P500 or Nasdaq 100. Since the Russell Indexes don’t include the Magnificent 7 stocks as do both the S&P and Nasdaq indexes, its performance has significantly lagged, but is still up around 25% for the year and averaged 10% or so for the last 3 years. When I look for ideas, I am not looking for names that will simply lag the market or some particular index and therefore outperform on some sort of relative basis, but rather ideas that have the potential to decline 50%+ regardless of the market conditions.

With that in mind, 2023 itself was an overall decent year from an idea generation perspective and was fairly typical as far as overall idea output is concerned. While I’m trying to increase my output a bit with the new format, I have always aimed to introduce 10-15 new ideas a year, and this year was no exception. The new owners of my former company decided to fire all of my traders and support staff towards the start of the year which kinda threw me and my idea-generation routine for a loop (a rather dry 3 month period), but that’s when I decided to head over to Substack and started migrating my content.

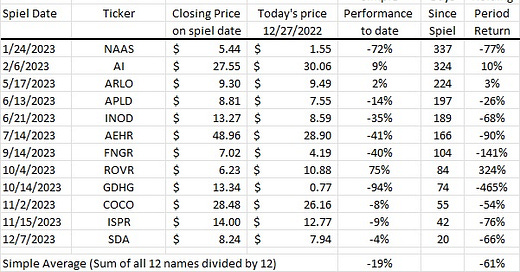

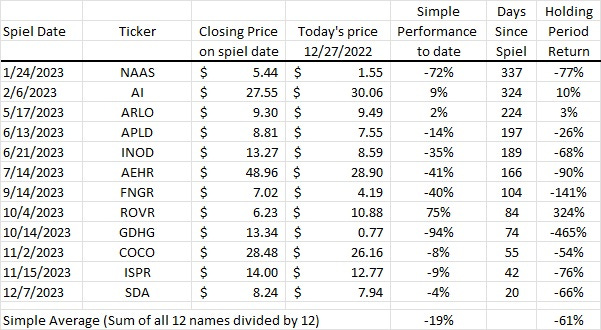

Anyhow, by the way I count ideas, I shared 12 new ideas (I only count those that receive an entire spiel rather than a quick overview) over the course of 2023 and provided updates on a couple dozen more. Performance over what can be an incredibly short time frame is really hard to judge, but of the dozen names I mentioned during the year, 75% (9) of them are either lower or substantially lower today than when they were originally mentioned while 2 of them are slightly higher and 1 of them (ROVR) is up 75% after announcing that it was going to be purchased by private equity. As is often the case, a single name was either able to mar or contribute greatly to the year’s overall performance.

On a simple return basis (and once again this is a purely theoretical exercise that should not be construed as any guarantee for future returns), the portfolio of names this year, as of today, is down an average of about 19%, and that is including every single name. Again, this assumes maintaining a position in each name through today and does not take into consideration that I may have already dropped a name at a lower or higher price than that which is currently reflected in the average. It also doesn’t include other things like margin interest or prime broker rebates, if any, which vary widely across the investment world.

If you attempt to calculate a holding period return (HPR) using the number of days since the spiel first appeared (same disclaimer…) then the average HPR is closer to 60%. Some ideas like GDHG naturally contributed a lot to the average, while others like ROVR detracted. But on average, the numbers look pretty good.

For what it’s worth, I really don’t know if anyone cares about any of these calculations. People tend to only care about their own performance or how the ideas they wind up doing performed for them, and everything else tends to be a distraction.

However, if I’m trying to sell you this product (which I am) then I believe calculating numbers like these makes some sense. Besides, I see some folks in the “activist” community talking about HPR’s and such, so thought I would take a stab at doing so myself.

Let’s also take a look at some other years and see how they have performed over the last 2,3, and 4 years, and for these, there will be no HPR calculation (it gets kinda messy over long periods since most of the names have long departed from my interest list).

If you go back to the report card I put out at the end of 2022, at that time only a single name (SHLS) was higher at that point in time than when I originally spieled on the idea. If you look at how that list of names performed in 2023, you will find that of the 17 names on the 2022 list (a couple spiels dropped at the tail end of 2021) a full 13 of them are lower in price today than they were on the day I published that list (meaning they have continued to decline), and of the 4 that are higher today (ASPN, RGTI, BLTE, and FLNC), only BLTE and FLNC are higher than where I originally highlighted the names (BLTE dropped down to $11 earlier this year, and had I been doing interest lists it surely would have been removed and then perhaps revisited).

2021? Of the 13 names I chose to highlight that year, only PDFS is slightly higher today than when I first pointed it out, while the other 12 are all lower (once again, since that list was put out on 12/16/2021 or a bit over two years ago, all of those names but 1 have continued to decline). Of these 12 names, quite a few of them are either down into the pennies or even fraction of a penny range.

On 2020’s list there were 18 names highlighted, and every single one of those names is lower today, with several in the penny range. Also to point out the danger of looking at anything here on any kind of a short-term basis, my April 2020 idea on INSG was up 123% when that report card was published, but today the stock trades for 22 cents and is down over 95% from the original spiel. There are many other names on that list that followed a similar pattern (2020 was the COVID year, which made for some odd stock price movement).

And that’s the basic pitch. I have close to a 30-year track record of picking out ideas that tend to underperform on an absolute basis, with many doing so quite dramatically. If you search for ideas such as these, please take the opportunity to subscribe below.

As far as ideas go, no, we’re not always going to be able to connect on every single name, borrow and liquidity constraints aside. There may be things I find of interest and that have tended to be wonderful signs of trouble for me that you may not agree with. I tend to dislike acquisition, roll-up, or cash flow stories, and I like to point out when companies are hiding poor performance behind funky accounting. Momentum stocks also tend to catch my attention, and I like trying to point out inconsistencies and picking out holes in unchallenged bull stories. There will inevitably be some folks who like buying any or all of those types of names, which is fine, but at least you will have some warning should things start to turn upside down.